Basic diversification in High-Yield Investment Programs means spreading your funds across a few different programs. Advanced diversification, however, is a more sophisticated art. It involves strategically allocating capital across various vectors of risk to construct a portfolio that is not just diversified, but also balanced and resilient. For the professional HYIP investor, this multi-layered approach is key to achieving more stable, long-term returns in a market defined by volatility. This guide explores advanced diversification strategies that go beyond the basics.

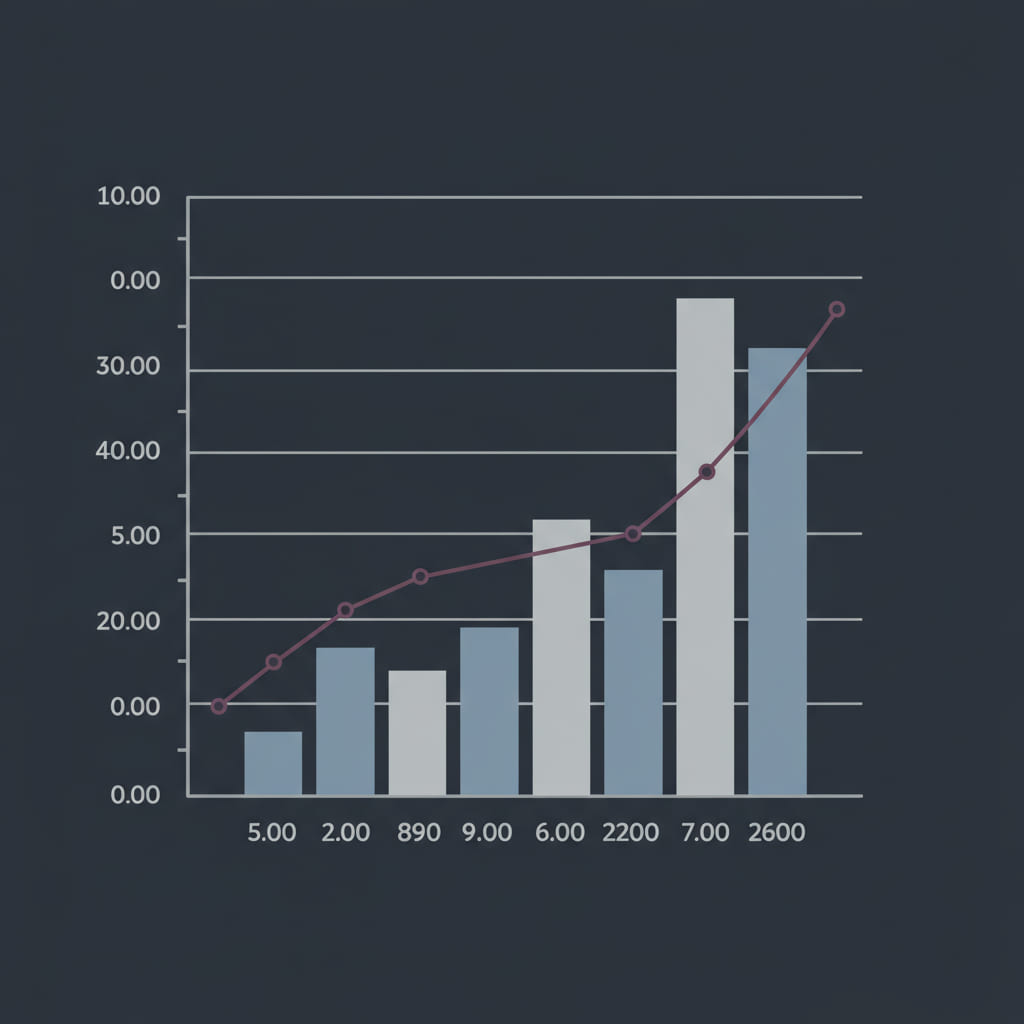

A core advanced strategy is to think of your portfolio in terms of risk tiers, much like a traditional investment portfolio. This provides structure and controls your overall risk exposure.

This tiered approach, as highlighted in this external guide on advanced diversification, ensures that the bulk of your capital is in more conservative positions. [17]

Another layer of diversification involves the investment plans themselves. A balanced portfolio might include:

This strategy is an extension of the principles discussed in our basic guide to HYIP diversification and the details of investment plans.

This is a highly subjective but powerful technique used by veteran investors. Over time, experienced players begin to recognize the 'styles' of different anonymous administrators. Some admins are known for running slow, steady programs. Others have a reputation for fast, aggressive programs that burn out quickly. Some use a particular type of website template or communicate in a certain way on forums. By tracking these characteristics, you can attempt to diversify your portfolio across what you perceive to be different, unrelated admin groups. This reduces the risk that a single admin, who may be running multiple sites, decides to scam with all of their programs at once, wiping out a significant portion of your portfolio. This requires deep immersion in the HYIP community and is a hallmark of a truly advanced approach.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.