The choice of payment processor is a defining characteristic of any High-Yield Investment Program. Historically, the field was dominated by e-currencies, with Perfect Money (PM) as the reigning champion. However, the rise of cryptocurrency has led to a surge in Bitcoin (BTC) HYIPs. For an investor, whether in a crypto-savvy city like Miami or a more traditional financial hub like Geneva, understanding the differences between these two ecosystems is vital. This article provides a head-to-head comparison of Bitcoin HYIPs and Perfect Money HYIPs, examining factors like transaction speed, anonymity, security, and the types of risks associated with each. The choice is not just about convenience; it reflects the nature of the HYIP itself. This deep-dive builds on the concepts introduced in our general overview of HYIP payment systems.

Perfect Money has been a staple of the HYIP industry for over a decade. Its platform is centralized and designed for fast, simple online payments.

An investor in Eastern Europe might be more comfortable with PM due to its long history and integration with local exchangers. However, this reliance on a single company is a significant systemic risk.

Bitcoin and other cryptocurrencies have become the preferred medium for many new HYIPs, appealing to a global, tech-literate user base.

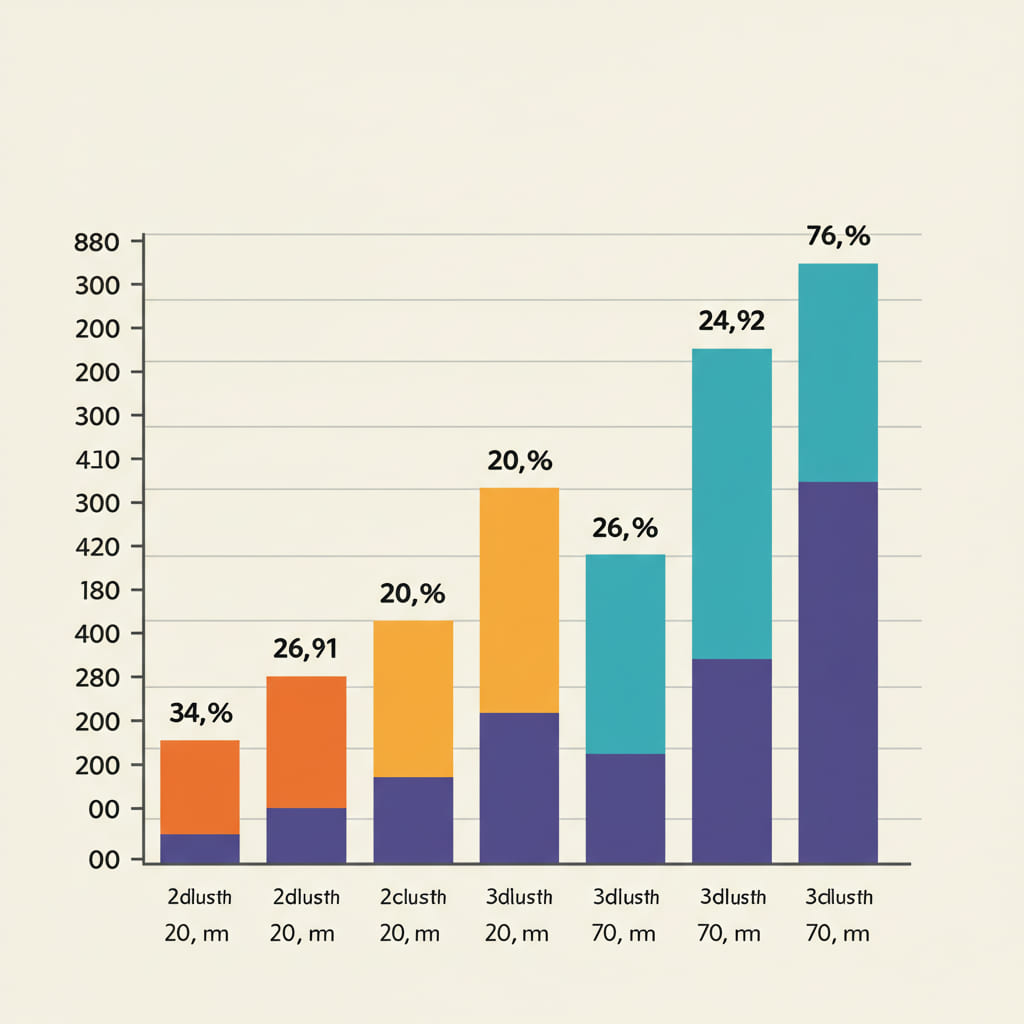

The chart below shows the typical transaction confirmation times, which is a key difference for investors.

Fintech analyst Jessica Morgan observes, 'The shift from Perfect Money to Bitcoin reflects a broader trend in online high-risk ventures. Admins prefer the pseudo-anonymity and borderless nature of crypto, while investors are drawn to the hype and potential for asset appreciation on top of the promised ROI.' This is a critical point for an investor in a place like Singapore, where both fintech and crypto are booming. Choosing between a BTC HYIP and a PM HYIP often means choosing between a modern, volatile, and anonymous system and an older, faster, but more centralized one. A well-diversified portfolio might even include programs from both categories to spread platform risk. It's also a crucial factor when analyzing newly launched HYIPs, as their choice of payment processor signals their target audience.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.