High-Yield Investment Program (HYIP) monitors are the central hubs of the HYIP world, but how do they actually operate? Understanding the business model and the mechanics behind these platforms is crucial for an investor, as it allows you to interpret their information with a necessary and healthy degree of skepticism. Monitors are not charities; they are for-profit businesses operating in a high-risk, unregulated market. Knowing how they make their money and how they determine their statuses is key to using them effectively. The primary business model of an HYIP monitor is based on listing fees. When an HYIP admin wants to promote their new program, they will pay a fee to be listed on the monitor's website. These fees can range from a modest sum for a basic listing to thousands of dollars for a premium 'sticky' position at the top of the page. This is the monitor's main source of revenue. This immediately creates a potential conflict of interest. The monitor's clients are the very HYIP admins they are supposed to be objectively evaluating. This is why choosing monitors with a long-standing reputation for integrity is so important.

So, how is the all-important 'Paying' or 'Scam' status determined? Most professional monitors will make a small, real-money deposit into every program they list. They will then attempt to make regular withdrawals according to the program's investment plan. If the withdrawals are processed in a timely manner, the status remains 'Paying.' If a withdrawal is missed or unduly delayed, the status is changed. This is the first layer of verification. The second, and arguably more important, layer is community reporting. Reputable monitors heavily rely on their user base to act as a distributed network of testers. Investors who signed up for a program using the monitor's referral link can report the status of their own withdrawals. When a monitor receives a number of credible 'not paying' reports from its members, it will investigate and, if confirmed, update the program's status to 'Scam.' This crowdsourced approach is a powerful defense against a selective scam, a tactic where an admin might only pay the monitor's small deposit while ignoring larger investor withdrawals. You can learn more about this dynamic in our guide to advanced monitoring techniques.

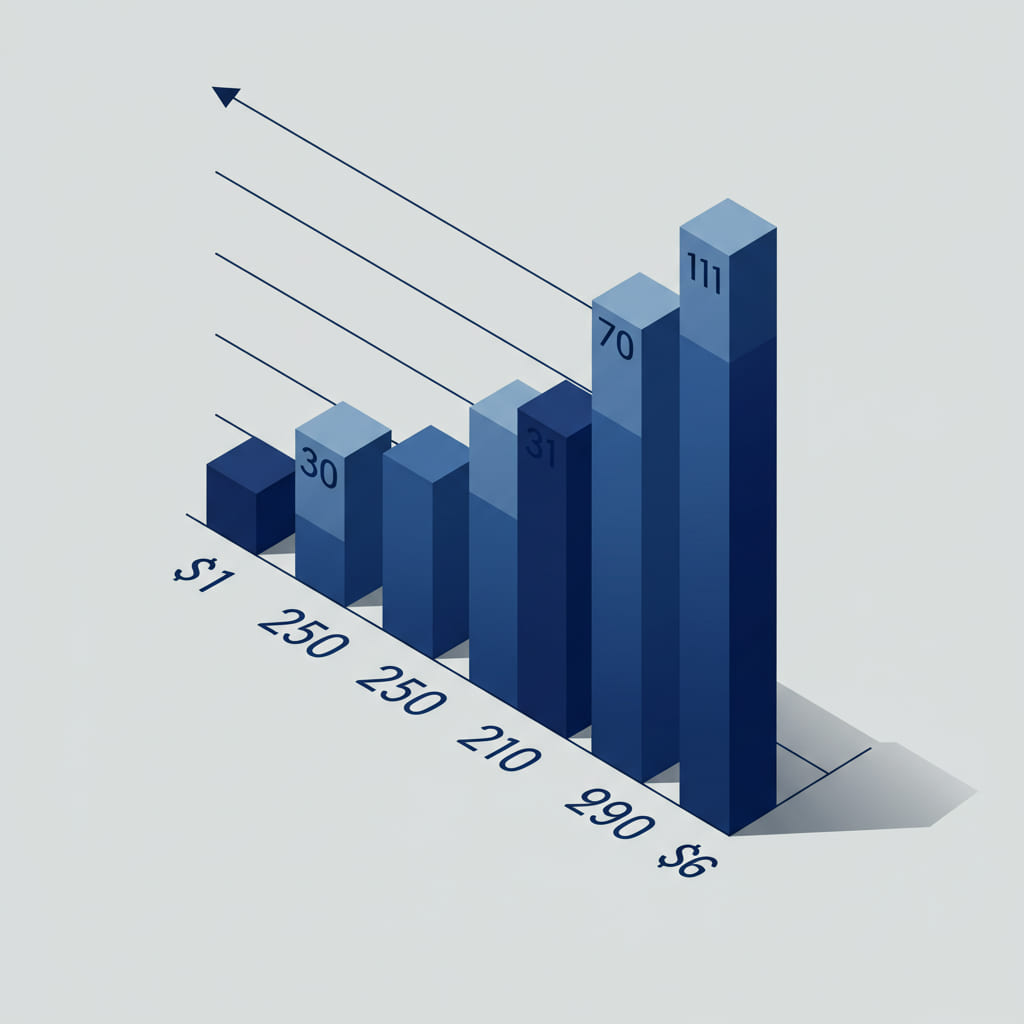

The second major revenue stream for a monitor is referral commissions. Every link from the monitor to an HYIP website is an affiliate link. When an investor clicks through and makes a deposit, the monitor earns a percentage. This creates another conflict of interest. A monitor is financially incentivized to drive as much traffic as possible to the programs it lists, especially those that offer high referral commissions. Edward Langley, a London-based investment strategist, advises, “An investor must always view a monitor as both a service provider and a marketing platform. The data they provide is invaluable, but you must never forget that they are also an affiliate marketer. Their goal is not just to inform you, but to get you to click and deposit.” For a visual, imagine a diagram showing the flow of money between an admin, a monitor, and an investor.  . Understanding these mechanics doesn't mean you should distrust all monitors. On the contrary, the best monitors work hard to maintain their reputation for accuracy because they know that trust is their most valuable asset. However, this knowledge should empower you to use them as a tool, not as an infallible oracle, and to always cross-reference information and do your own research.

. Understanding these mechanics doesn't mean you should distrust all monitors. On the contrary, the best monitors work hard to maintain their reputation for accuracy because they know that trust is their most valuable asset. However, this knowledge should empower you to use them as a tool, not as an infallible oracle, and to always cross-reference information and do your own research.

Author: Edward Langley, London-based investment strategist and contributor to several financial watchdog publications. He focuses on risk assessment and online financial security.