In the high-risk environment of High-Yield Investment Programs, a 'hype monitor' or HYIP monitor is an essential tool for many investors. These websites act as independent watchdogs, aiming to provide reliable information about the operational status of hundreds of HYIPs. Their primary function is to track which programs are currently processing withdrawals ('Paying') and which have stopped ('Scam'). For an investor in Toronto or Johannesburg, who may not have direct insight into a program's operations, these monitors serve as a crucial first line of defense. However, their reliability can vary, and understanding how they work is key to using them effectively.

A reputable HYIP monitor operates by following a clear, systematic process. Here’s a step-by-step breakdown of how they typically function:

A screen full of green 'Paying' statuses can be reassuring, but it's vital to look deeper. Here’s what to consider:

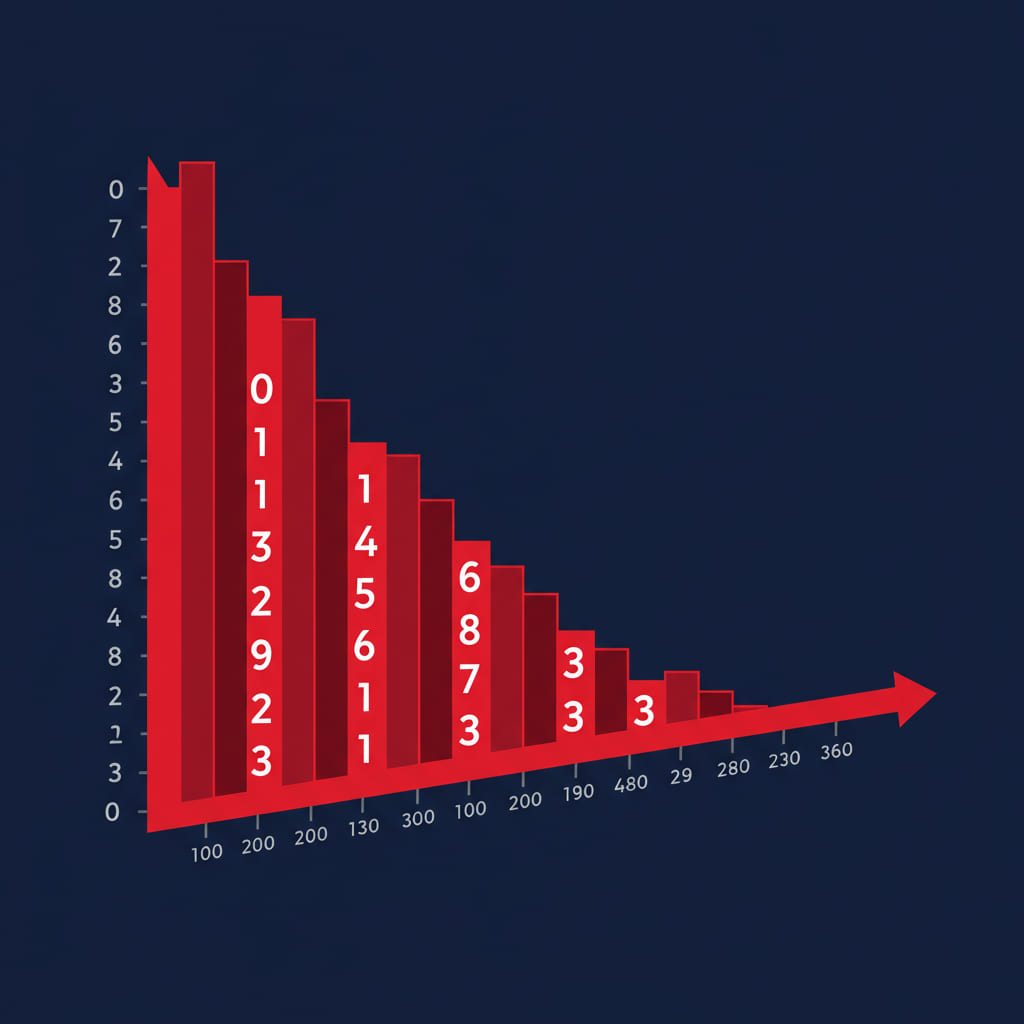

By tracking a HYIP across several monitors over time, you can sometimes visualize its lifecycle. The chart below represents a hypothetical program's status change as reported by a monitoring service.

This visualization helps investors in cities like Mumbai and Shanghai understand that even programs with a long 'Paying' history are not immune to collapse. The goal is not to find a program that will never scam, but to potentially exit before it does. For related information, see our articles on identifying red flags and understanding basic investment strategies.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.