The allure of high returns makes HYIPs a tempting landscape for many, but it's also a minefield of scams. Distinguishing a potentially 'paying hyip' from an imminent 'scam hyip' is the most critical skill for any participant. Financial pyramids are designed to look legitimate in their early stages, but certain red flags can help you avoid losing your capital. Here we outline the most common warning signs that a HYIP project is likely a scam waiting to happen.

The most obvious red flag is the promised return on investment (ROI). Legitimate investment opportunities rarely offer guaranteed returns, let alone rates of 2%, 5%, or even 10% per day. Ask yourself: what kind of business can sustainably generate such profits? If a program promises returns that seem too good to be true, they almost certainly are. This is the fundamental principle that separates speculation from investment. For a basic understanding of what these programs are, you can read our beginner's guide to HYIPs.

A legitimate investment firm is transparent about its strategy. A HYIP scam, on the other hand, will be deliberately vague. They use buzzwords like 'forex trading', 'crypto arbitrage', 'AI-powered bots', or 'gold trading' without providing any verifiable proof or details. They won't have audited reports, and their 'traders' are often stock photos. Always demand transparency. If the 'how' is a secret, your money is at risk. This lack of clarity is a classic trait of a financial pyramid.

While referral programs are a legitimate marketing tool, HYIP scams rely on them as their primary source of new capital. If a program offers multi-level referral commissions (e.g., you get 10% from your referrals, 5% from their referrals, and 2% from the next level), it's a strong indicator of a Ponzi scheme. The business model is focused on recruitment, not on generating investment returns. Your 'profit' is simply the deposit of someone you brought in. Recognizing this structure is key to managing your risk effectively.

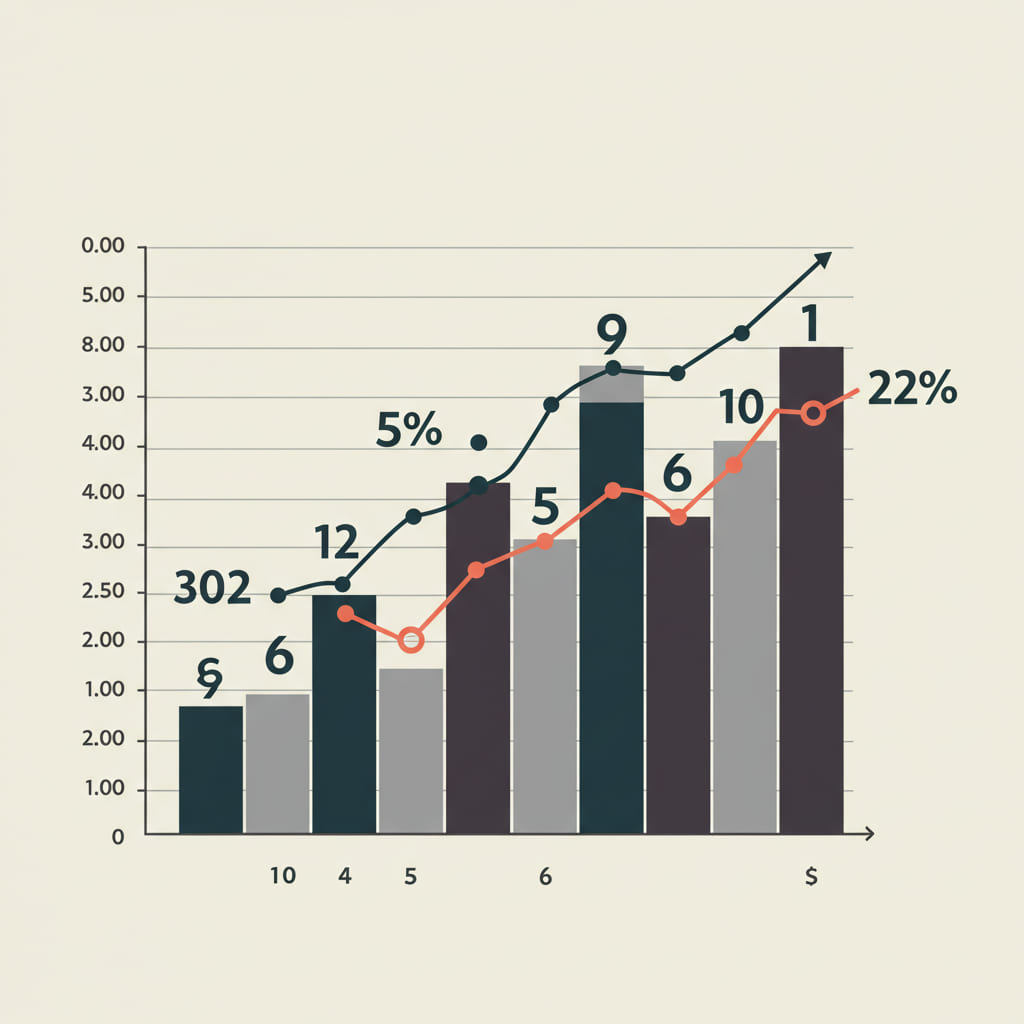

As the chart above illustrates, these models require exponential growth in new members to sustain payments, which is mathematically impossible in the long run. The collapse is not a matter of 'if', but 'when'.

Who is running the program? In most HYIP scams, the team is anonymous. They use fake names, stock photos, and provide no verifiable professional history. The company registration details are often from jurisdictions with lax oversight, like the Marshall Islands or St. Vincent. A team that isn't willing to stand behind its project in cities like London or Singapore is a team you shouldn't trust with your money. To find projects with slightly more transparency, you can check HYIP rating and project lists, but even then, caution is paramount.

Author: Edward Langley, London-based investment strategist and contributor to several financial watchdog publications. He focuses on risk assessment and online financial security.