For investors trying to find their way through the dense forest of High-Yield Investment Programs, a good rating list can seem like a treasure map. Compiled by monitors and experienced investors, these lists rank HYIPs based on various criteria, aiming to separate the wheat from the chaff. A well-curated list can be an excellent starting point for your research, helping you filter out the low-quality, 'fast-scam' projects and focus on those that show greater potential. However, it's crucial for investors, whether in Toronto or Tokyo, to understand that these lists are not infallible gospel. They are a tool for research, not a substitute for it. The terms 'best' and 'top-rated' are highly relative in a market where every investment carries extreme risk.

The methodologies for ranking HYIPs can vary, but reputable rating lists generally consider a combination of quantitative and qualitative factors:

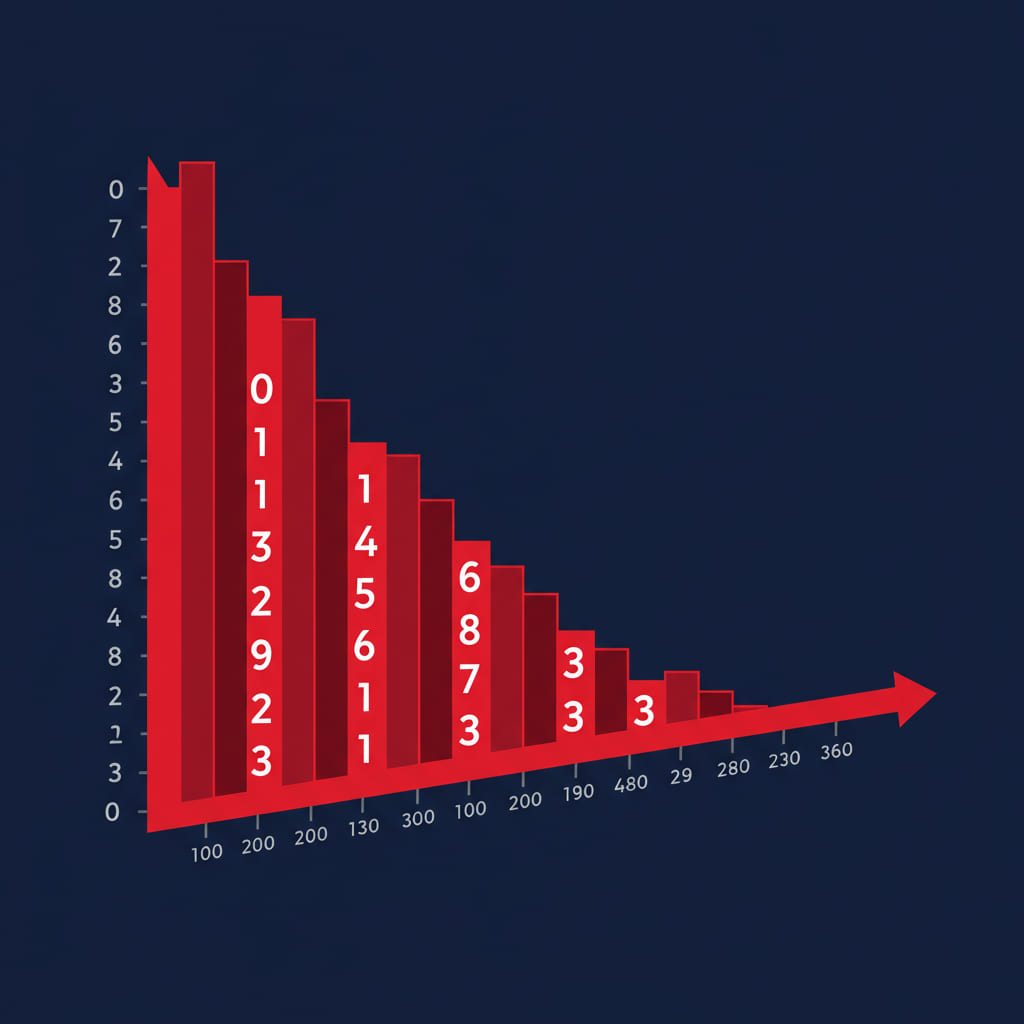

The chart below illustrates a typical weighting of these factors in a quality rating system.

Understanding this breakdown helps you see that a rating is a composite score, not just a measure of popularity. For further reading on how to assess financial products, consulting resources from consumer protection agencies like the Consumer Financial Protection Bureau can provide a valuable risk-aware framework. Even top-rated programs can and do fail, which is why diversification, as explained in our guide to building a HYIP portfolio, is so critical.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.