The term 'yield' is the central promise of any High-Yield Investment Program. The percentage of return is the primary metric used to attract investors. However, in an environment built on unsustainable models, what constitutes a 'realistic' or 'plausible' yield? Understanding the subtle differences in plan structures and percentages is key to differentiating between a program that might last a few weeks and one designed to collapse in a few days. This analysis is crucial for investors from Berlin to Bangkok who are trying to make strategic, rather than purely emotional, decisions. For a baseline, one can look at the yields of high-risk corporate bonds or junk bonds via financial news sites like Bloomberg to see how disconnected HYIP yields are from any regulated market.

In the HYIP world, 'realistic' does not mean sustainable in the long term. No HYIP plan is truly sustainable. Instead, 'realistic' refers to a plan that is mathematically structured to survive long enough for at least one or two cycles of investors to profit, creating the buzz needed to attract the masses. This is a critical part of the Ponzi lifecycle.

We can break down HYIP plans into three broad categories based on their offered yield:

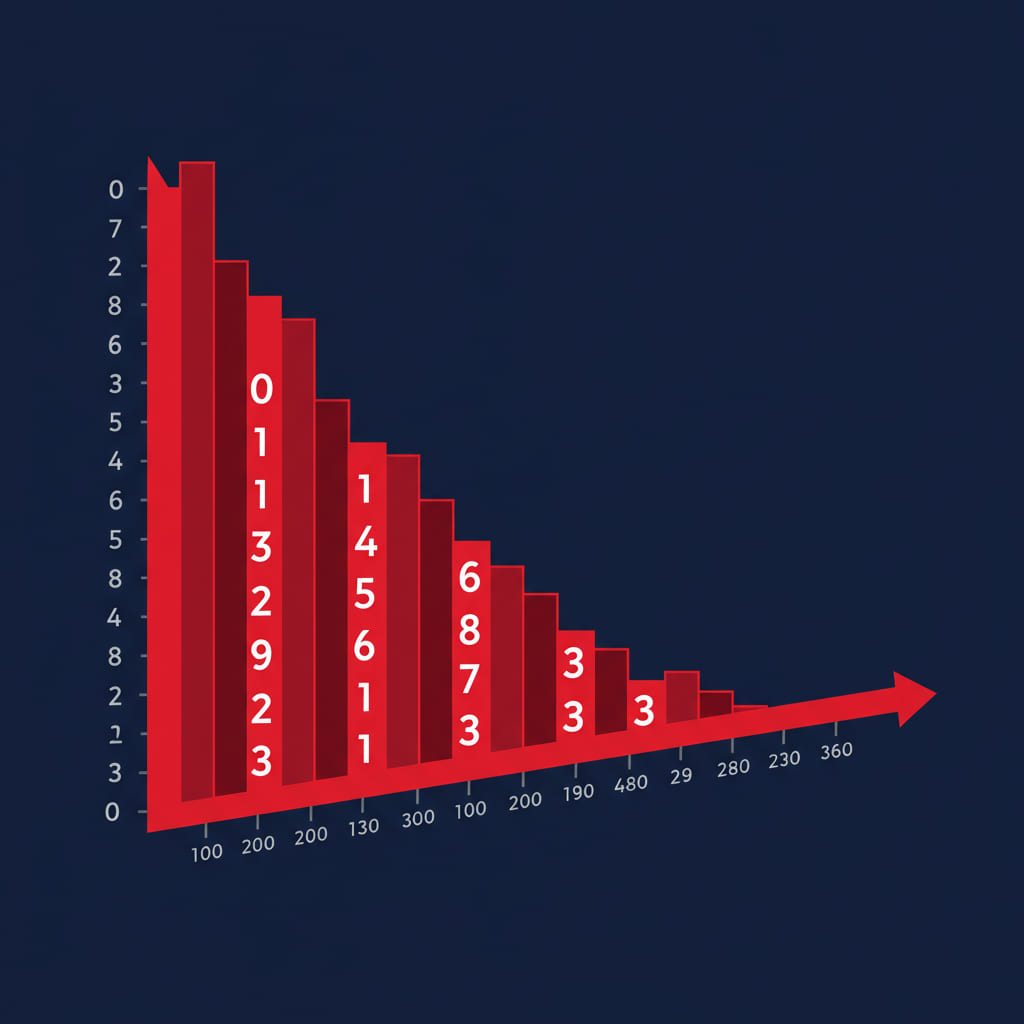

The chart below shows the inverse relationship between the daily yield of a HYIP and its probable lifespan.

"When I analyze a HYIP's investment plan, I'm not assessing its legitimacy; I'm assessing the admin's intentions. A plan offering 1% daily suggests the admin wants to build a long-term Ponzi. A plan offering 25% daily tells me the admin wants to collect as much money as possible in 72 hours and run. Both are scams, but they require different investment strategies. Understanding the yield tells you what kind of game the admin is playing, and that is the most 'realistic' assessment you can make."

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.

By learning to categorize HYIPs based on their offered yield, you can better align your investment strategy with the likely behavior and lifespan of the program. Avoid the impossibly high numbers and focus on plans that, within the skewed reality of the HYIP world, have a mathematical chance of surviving your chosen investment term. This is a crucial element of the investment details you must analyze.