Investing in High-Yield Investment Programs (HYIPs) is an inherently risky endeavor. The potential for high returns is directly proportional to the risk of losing your entire investment. While it's impossible to eliminate risk completely, a disciplined and strategic approach to risk management can significantly improve your chances of success and protect you from catastrophic losses. This guide provides a comprehensive overview of the most effective risk management strategies for HYIP investors, from foundational principles to advanced techniques. The cornerstone of HYIP risk management is a principle that cannot be overstated: only invest what you can afford to lose. This is the golden rule that should govern every investment decision you make in this space. Before you deposit any funds into an HYIP, take a realistic look at your financial situation and determine an amount that, if lost, would not impact your financial stability or cause you undue stress. This amount is your 'risk capital.' By strictly adhering to this rule, you can approach HYIP investing with a clear mind, free from the emotional pressure that can lead to poor decisions. An investor in a high-cost-of-living city like Oslo or Copenhagen would be particularly mindful of this principle, ensuring their speculative investments do not jeopardize their financial security.

The second most important risk management strategy is diversification. The old adage 'don't put all your eggs in one basket' is particularly relevant to the volatile HYIP market. Instead of investing your entire risk capital into a single program, spread it across several different HYIPs. This way, if one program collapses and turns into a scam, you won't lose your entire investment. Your losses from the failed program can potentially be offset by the profits from your other, more successful investments. The key to effective diversification is to choose a variety of programs with different characteristics. You might invest in a mix of short-term, medium-term, and long-term plans. You could also diversify across programs with different themes, such as crypto trading, forex, or gold. The goal is to create a portfolio of investments that are not all correlated, reducing your overall risk exposure. As Edward Langley, a London-based investment strategist, advises, “A well-diversified HYIP portfolio is like a well-built ship with multiple watertight compartments. A leak in one compartment won't sink the entire vessel.”

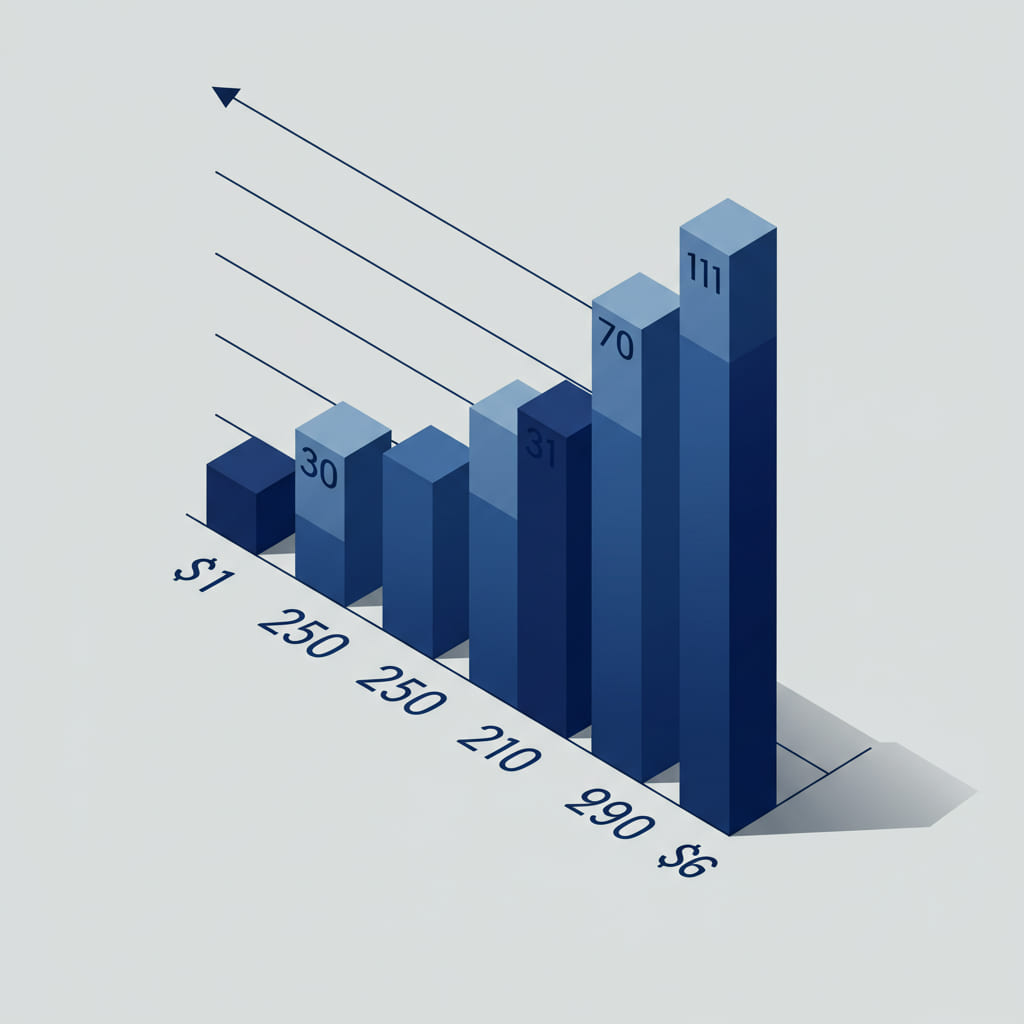

Risk management in the HYIP world is not a one-time setup; it's an ongoing process. You need to continuously monitor your investments and the overall market. This means regularly checking the status of your chosen programs on HYIP monitoring sites and staying active on community forums to keep abreast of any news or potential issues. An equally important part of your strategy is having a clear exit plan for each investment. Before you even make a deposit, you should decide on your profit target and your stop-loss point. For example, you might decide to withdraw your initial investment as soon as your earnings reach that amount, allowing you to play with 'house money' from that point on. Alternatively, you might decide to pull out of a program completely if it shows any signs of trouble, such as payment delays or a sudden change in its investment plans. For a visual representation of a risk management workflow, consider a flowchart that outlines the steps from setting your risk capital to exiting an investment.  . By combining the foundational principle of investing only what you can afford to lose with the powerful strategies of diversification and continuous monitoring, you can build a robust risk management framework. This disciplined approach is what allows seasoned investors from financial hubs like Shanghai and Mumbai to navigate the HYIP market with confidence and to achieve long-term profitability. To build a solid strategy, it's essential to understand the basics of what you're investing in, as detailed in this guide on HYIP Basics. Furthermore, your risk management should be informed by a solid understanding of how to spot fraudulent schemes, which is covered in the article on HYIP scams and risks.

. By combining the foundational principle of investing only what you can afford to lose with the powerful strategies of diversification and continuous monitoring, you can build a robust risk management framework. This disciplined approach is what allows seasoned investors from financial hubs like Shanghai and Mumbai to navigate the HYIP market with confidence and to achieve long-term profitability. To build a solid strategy, it's essential to understand the basics of what you're investing in, as detailed in this guide on HYIP Basics. Furthermore, your risk management should be informed by a solid understanding of how to spot fraudulent schemes, which is covered in the article on HYIP scams and risks.