Every High-Yield Investment Program, with almost no exceptions, follows a predictable lifecycle. Understanding these phases is perhaps the most critical knowledge an investor can possess, as it allows them to assess where a program is in its lifespan and make more informed decisions about when to enter and, more importantly, when to exit. This pattern is universal, observed in programs targeting investors everywhere from the United States to the Philippines.

This is the beginning. A new HYIP appears online with a professional-looking website, attractive investment plans, and a marketing push.

The HYIP has now established a reputation as a 'paying' program. It's listed on numerous monitors and has a large, active user base.

This is the tipping point. The growth of new deposits begins to slow down. The daily payouts owed to existing investors start to equal or exceed the new capital coming in.

Analyst's Take: Jessica Morgan, a fintech analyst, explains, "This is the most dangerous phase. The admin knows the cash flow is turning negative. They will begin to implement 'scam tactics' to prolong the program and maximize their final take. This is where vigilance is paramount."

The end has arrived. The administrator stops all payments and disappears with the remaining funds in the program's wallets.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.

Every High-Yield Investment Program, with almost no exceptions, follows a predictable lifecycle. Understanding these distinct phases is one of the most powerful analytical tools an investor can possess. It allows you to contextualize a program's behavior, anticipate its next move, and, most importantly, know when it's time to get out. From its covert launch to its dramatic, inevitable collapse, the HYIP lifecycle is a fascinating case study in market dynamics and human psychology. An investor in Milan who understands this cycle is far better equipped than one in Miami who only looks at the daily ROI.

The vast majority of HYIPs are unsustainable Ponzi schemes, and their lifecycle is engineered to maximize deposits before the collapse. While the duration of each phase can vary wildly—from days to months—the sequence is remarkably consistent. Recognizing which phase a program is in is key to a successful entry and exit strategy. A failure to do so means you're likely to invest during the final, most dangerous phase, becoming exit liquidity for the administrators and earlier investors. As stressed in our guide on HYIP scams, this is the default outcome for the uninformed.

We can break down the lifecycle into four primary stages:

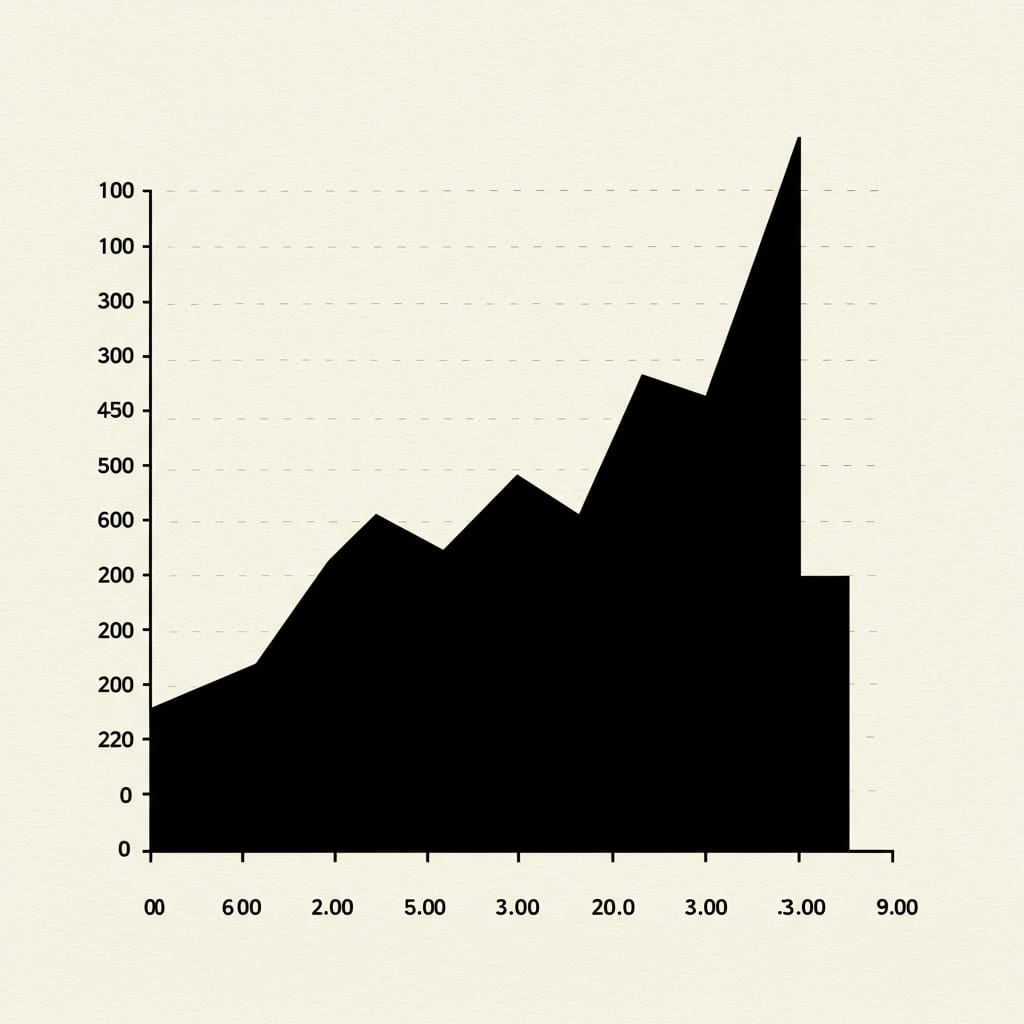

This lifecycle can be visualized on a timeline, as shown below.

Your goal as an investor is to enter during late Phase 1 or early Phase 2 and to have fully exited before the end of Phase 3. This requires constant vigilance and an unsentimental, data-driven approach, using tools like HYIP monitors to track the program's health.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.