For any serious HYIP investor, from Shanghai to San Francisco, a reliable monitoring service is an indispensable tool. These platforms act as third-party watchdogs, tracking the payment status, uptime, and community feedback for hundreds of HYIPs. However, not all monitors are created equal. Some are biased, some are outdated, and some are even run by HYIP admins themselves to create a false sense of security. This guide will teach you how to navigate the world of HYIP monitoring effectively. We'll explore the features of top-tier monitors, explain how to interpret their statuses ('Paying', 'Waiting', 'Problem', 'Scam'), and provide techniques to cross-reference information for a more accurate picture. Using a monitor correctly can be the difference between a profitable exit and a total loss. It provides crucial data points that, when combined with your own research on topics like spotting scams, can significantly improve your odds.

A trustworthy monitor is more than just a list of programs. It's a data hub. Here's what separates the best from the rest:

Understanding the common terminology is key:

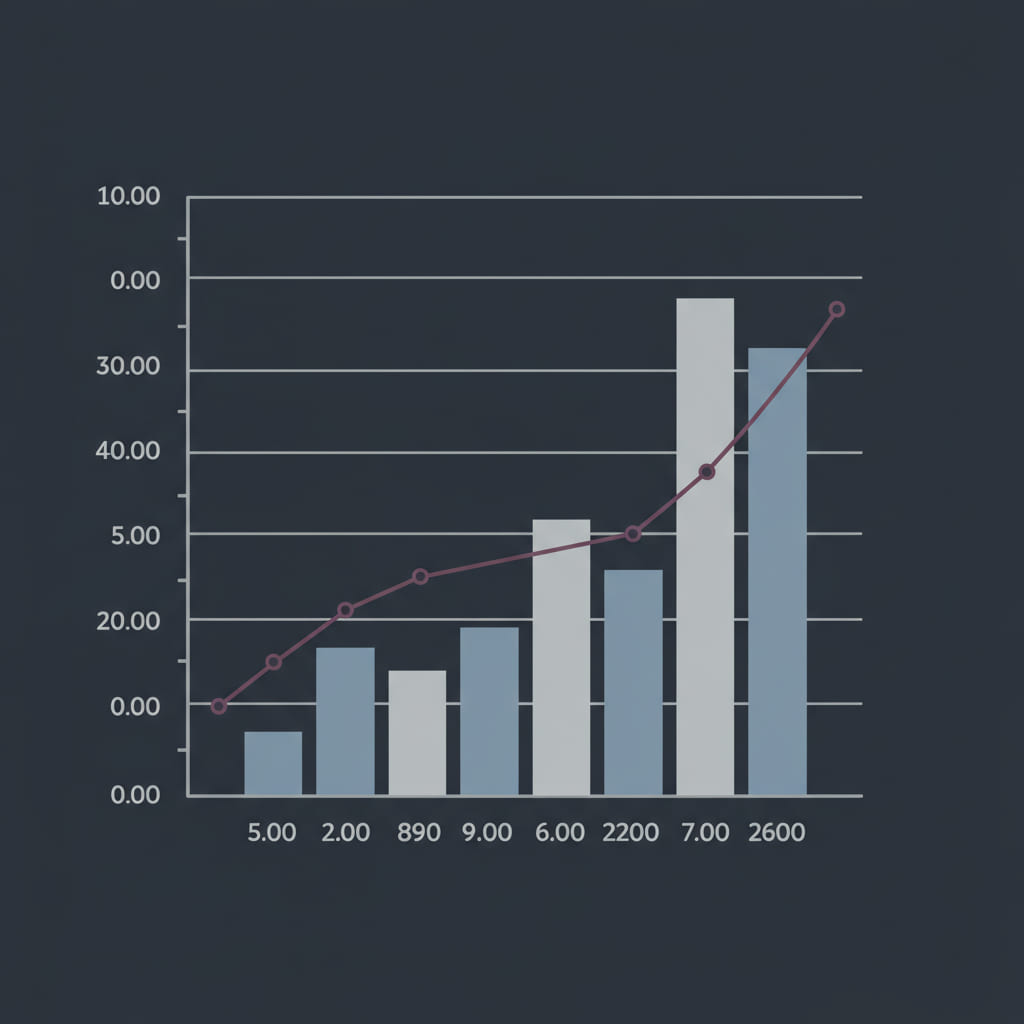

The chart below illustrates how a HYIP's status typically changes on monitors during its lifecycle.

As Matti Korhonen, a financial researcher from Helsinki, states, 'A monitor's data is a snapshot, not a prophecy. Use it to validate what you already suspect, not to blindly follow.' Never rely on a single monitor. Cross-reference at least 2-3 reputable ones to confirm a program's status. For example, an investor in Johannesburg should check what monitors popular in Africa, Europe, and Asia are saying to get a global consensus. This aggregated approach smooths out any individual monitor's bias or lag time. Learning about the different newly launched HYIPs is another key part of a successful strategy.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.