The primary attraction of High-Yield Investment Programs is their promise of extraordinary profitability. Understanding how to calculate your potential Return on Investment (ROI) and the mechanics of compounding is essential for evaluating these programs. However, it's even more important to understand the immense risks associated with these concepts in the context of HYIPs, a lesson well-understood by seasoned investors from Amsterdam to Sydney.

ROI is a simple metric used to evaluate the profitability of an investment. In its most basic form, the formula is:

ROI = (Net Profit / Cost of Investment) x 100

For a HYIP, the 'Cost of Investment' is your initial deposit, and the 'Net Profit' is the total amount withdrawn minus your initial deposit.

Example:

This calculation assumes the program pays out for the full term, which is a significant uncertainty. To plan your strategy, you should also calculate your break-even point. In the example above, at 2% per day ($4), it would take 50 days to earn back your $200 principal if the plan ran indefinitely, or you'd need the plan to last its full term to get the principal back at the end. Understanding these numbers is a key part of the risk management process.

Compounding is the process of reinvesting your earnings to generate further profit. HYIPs often promote this feature aggressively because it keeps money within their system. While the potential for exponential growth is mathematically alluring, it is a high-risk strategy in the HYIP world.

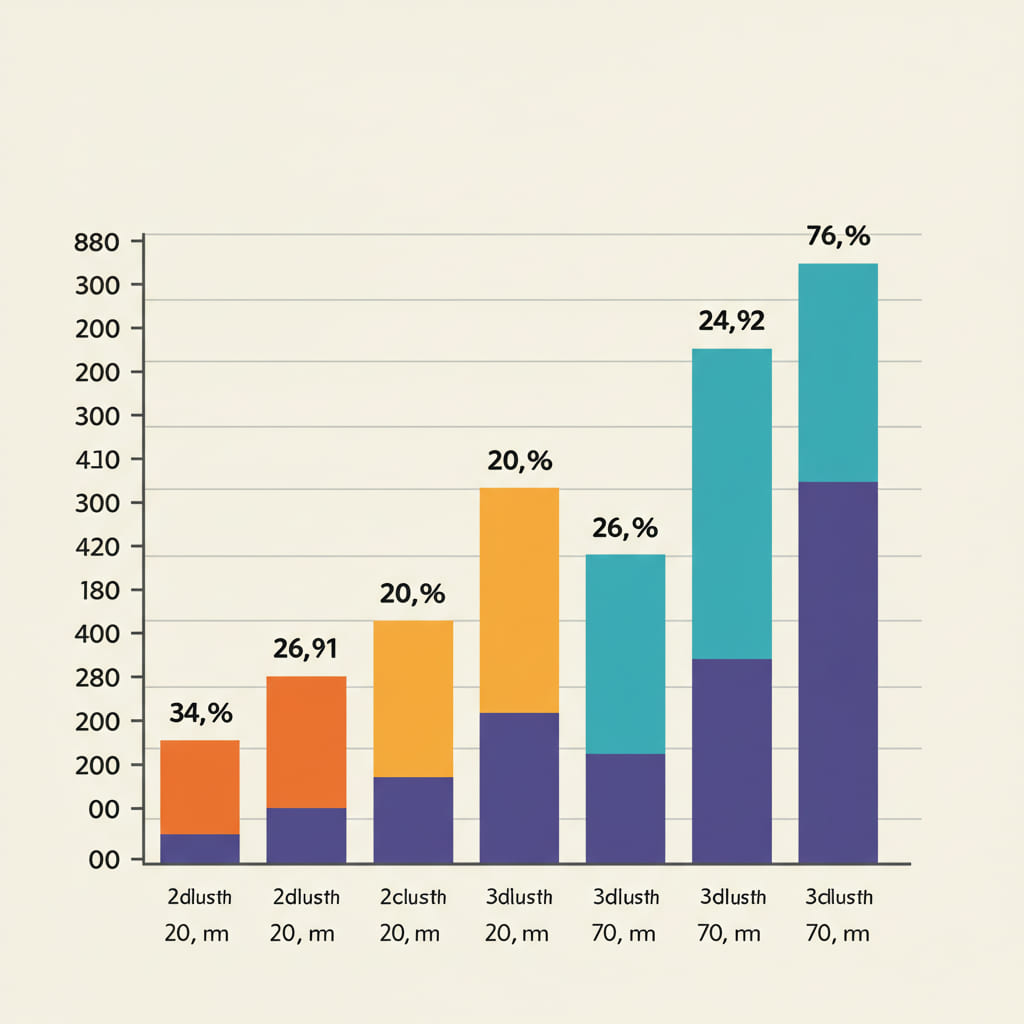

Consider a $1000 investment with a 2% daily return over 30 days:

As the chart shows, with simple interest (withdrawing profits daily), the profit is linear. With compounding, the growth curve becomes exponential. After 30 days, the compounded amount would be significantly higher. However, this entire amount remains locked in the program, vulnerable to a sudden shutdown. As analyst Jessica Morgan notes, "Compounding in a HYIP is a bet against the clock. You are betting that your exponential growth will outpace the admin's timeline for exiting with everyone's funds. It's a bet that rarely pays off."

A safer approach is to manually 'compound' by withdrawing funds to your private wallet (using systems like Bitcoin or other e-currencies) and then deciding whether to reinvest in the same or, more wisely, a different program, as discussed in our guide to new HYIPs.

Profitability in HYIPs is a race against time. Calculating ROI and understanding compounding are necessary skills, but they must be paired with the sober realization that these figures are hypothetical until the money is safely back in your own wallet.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.