For investors navigating the crowded and often confusing landscape of High-Yield Investment Programs (HYIPs), rating systems can be a powerful tool. Provided by HYIP monitoring websites, these ratings offer a seemingly straightforward way to gauge the quality and reliability of a program. However, simply investing in the highest-rated programs is not a guaranteed recipe for success. A more nuanced and strategic approach is required to use these ratings effectively. This guide will walk you through the process of developing a robust HYIP rating strategy, helping you to interpret ratings critically and integrate them into a broader due diligence process. The first step in any effective rating strategy is to understand that not all ratings are created equal. Different monitoring sites use different criteria and methodologies to rate HYIPs. Some may place a heavy emphasis on the program's age and payment history, while others might give more weight to the design of the website and the attractiveness of the investment plans. Before you put too much faith in a particular monitor's ratings, take some time to understand how they are calculated. A reputable monitor will be transparent about its rating system. Look for a detailed explanation of the factors they consider and how they are weighted. As Jessica Morgan, a U.S.-based fintech analyst, suggests, “A rating is only as reliable as the methodology behind it. Investors should prioritize monitors that offer transparency and a data-driven approach to their ratings.”

A single rating score, while useful, only tells part of the story. A truly effective strategy involves looking beyond the number and analyzing the underlying data. For example, a program might have a high rating, but if you dig deeper, you may find that it's a very new program with a limited track record. Conversely, a program with a slightly lower rating might have a long and stable history of payments, making it a potentially safer bet. Don't just look at the overall rating; examine the individual components that contribute to it. Does the program have a strong payment history? Is the community feedback positive? Are there any red flags, such as recent payment delays or a lack of communication from the admin? It's also crucial to look for trends. Is a program's rating consistently improving, or has it recently started to decline? A downward trend can be an early warning sign that a program is in trouble. For a deeper understanding of investment strategies, consider this resource from a trusted financial authority: Understanding Investment Risk. [5] By taking a more holistic and analytical approach, you can extract a wealth of valuable information from HYIP ratings, moving beyond a simple 'good' or 'bad' assessment. This analytical approach is common among successful investors in financially savvy cities like Hong Kong and Singapore.

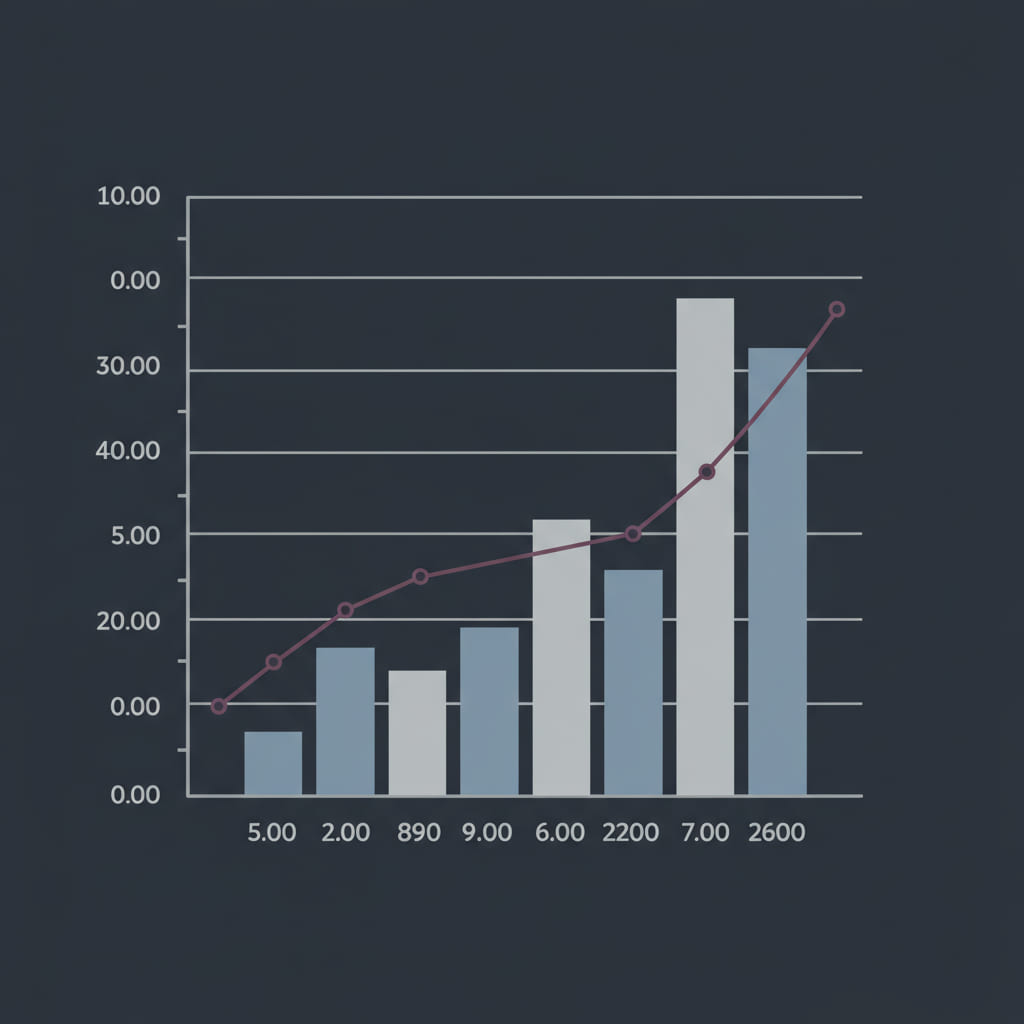

HYIP ratings should not be used in isolation. They are most effective when used as one component of a comprehensive investment strategy. Here's how you can integrate ratings into your workflow: Use ratings as a screening tool to identify a shortlist of potentially interesting programs. From there, conduct your own in-depth due diligence. This should include reading discussions on multiple forums, checking the program's status on several other monitors, and carefully analyzing the program's website and investment plans. For a visual representation of this process, consider a funnel diagram showing how you can narrow down a large number of HYIPs to a few well-researched investment choices.  . Diversification is another key element. Don't just invest in the single highest-rated program. Spread your investment across several programs with strong ratings and positive community feedback. This will help to mitigate your risk if one of the programs fails. Finally, remember that ratings are not static. They can change quickly. Continuously monitor the ratings of the programs you are invested in and be prepared to act decisively if you see any signs of trouble. By developing a sophisticated and strategic approach to HYIP ratings, you can transform them from a simple indicator into a powerful tool for making smarter, more informed investment decisions. This is a skill that distinguishes casual participants from serious investors in markets from Berlin to Buenos Aires. To get a better grasp of the available projects, you can explore various HYIP rating and lists. Additionally, understanding how these ratings are compiled by HYIP monitoring services is fundamental.

. Diversification is another key element. Don't just invest in the single highest-rated program. Spread your investment across several programs with strong ratings and positive community feedback. This will help to mitigate your risk if one of the programs fails. Finally, remember that ratings are not static. They can change quickly. Continuously monitor the ratings of the programs you are invested in and be prepared to act decisively if you see any signs of trouble. By developing a sophisticated and strategic approach to HYIP ratings, you can transform them from a simple indicator into a powerful tool for making smarter, more informed investment decisions. This is a skill that distinguishes casual participants from serious investors in markets from Berlin to Buenos Aires. To get a better grasp of the available projects, you can explore various HYIP rating and lists. Additionally, understanding how these ratings are compiled by HYIP monitoring services is fundamental.