Venturing into the world of High-Yield Investment Programs (HYIPs) without the proper tools is akin to navigating a minefield blindfolded. The single most important tool in any investor's arsenal is the HYIP monitor. These specialized websites act as the watchtowers of the HYIP ecosystem, providing crucial, real-time data that can mean the difference between a calculated profit and a catastrophic loss. For any investor, from a beginner in Manila to a seasoned player in Berlin, understanding what a HYIP monitor is and how to use it effectively is not just recommended; it is absolutely essential. A HYIP monitor is a third-party platform that tracks, lists, and evaluates various HYIPs. Its primary function is to provide a status report on whether a program is currently paying its investors. This is typically displayed with simple, color-coded labels: 'Paying' (green), 'Waiting' (orange), and 'Scam' (red). This status is determined by the monitor's own investments in the program, as well as by reports from its community of users. When a monitor successfully receives a withdrawal, the status remains 'Paying.' If payments are delayed or stop altogether, the status is updated to reflect this, warning potential investors to stay away.

However, modern HYIP monitors offer much more than just a simple status label. They are rich data environments that provide a wealth of information for due diligence. On a typical monitor, you will find detailed statistics for each program, including its launch date (uptime), the investment plans it offers, and the types of HYIP Payment Systems it accepts, such as Bitcoin or Perfect Money. This allows for a quick, at-a-glance comparison of different opportunities. Furthermore, reputable monitors have integrated community features. As we explore in our article on HYIP Community and Forums, these discussion threads are invaluable. Investors post their own payment proofs, share experiences, and raise the alarm about potential issues long before a monitor's status might officially change. According to Jessica Morgan, a U.S.-based fintech analyst, “An HYIP monitor's data provides the quantitative analysis, but its forums provide the qualitative. A savvy investor must use both in tandem. The numbers tell you what the program is doing; the community tells you how it feels.”

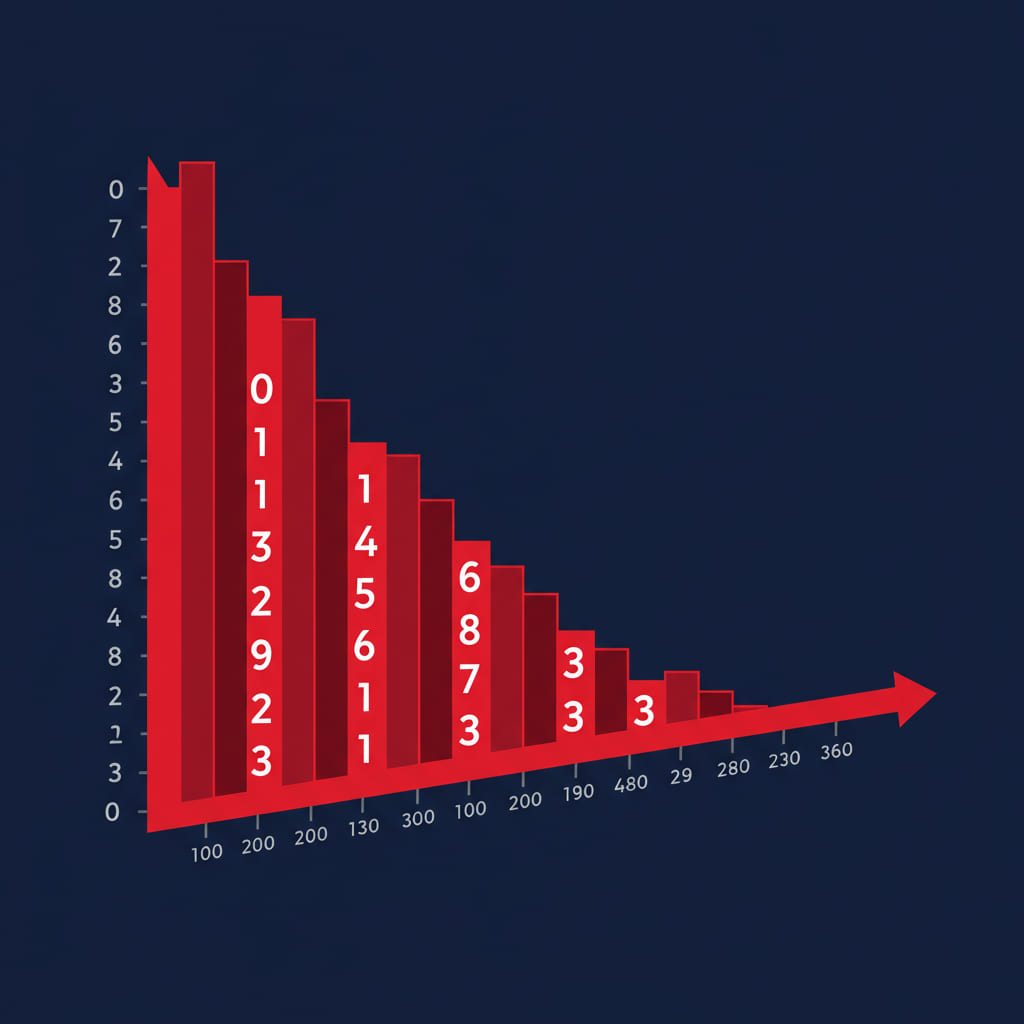

Not all monitors are created equal. The ecosystem is flooded with dozens of them, and some are less reliable than others. Some may even be run by HYIP admins themselves to promote their own programs. It is crucial to use several well-established, reputable monitors that have been operating for many years and have a large, active community. Never rely on a single source of information. Cross-referencing the status of a program across three or four different major monitors is a fundamental step in any sound investment strategy. For a visual representation of how to compare monitors, imagine a feature comparison chart.  . In conclusion, the HYIP monitor is your window into a deeply opaque market. It provides a level of transparency and accountability that would otherwise not exist. Learning to use these platforms effectively—to read their data, to interpret their community discussions, and to cross-reference their information—is the first and most important skill you must master. It is the foundation upon which all successful HYIP investing is built.

. In conclusion, the HYIP monitor is your window into a deeply opaque market. It provides a level of transparency and accountability that would otherwise not exist. Learning to use these platforms effectively—to read their data, to interpret their community discussions, and to cross-reference their information—is the first and most important skill you must master. It is the foundation upon which all successful HYIP investing is built.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.