In every form of investment, from government bonds to speculative startups, there is a fundamental relationship between risk and potential return (yield). The higher the potential reward, the higher the risk. This principle is not just true in the High-Yield Investment Program (HYIP) world; it is the absolute, unbreakable law that governs it. Every investor, from a beginner in Chicago to a seasoned pro in Moscow, must understand this trade-off to make rational decisions. Choosing a HYIP is not about finding the highest yield; it's about finding a level of risk you are willing to accept for a particular yield.

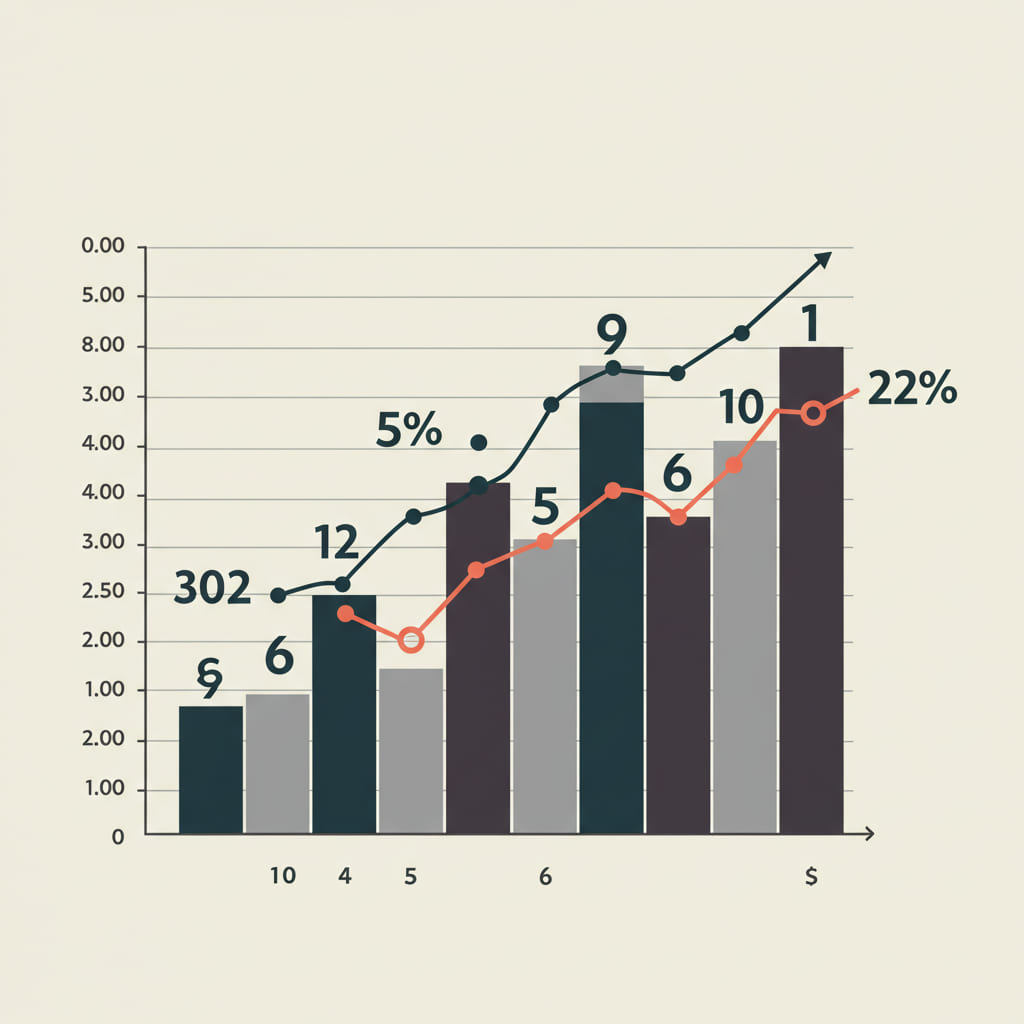

We can categorize HYIPs along a spectrum, from lower-risk (a relative term!) to extreme-risk. This spectrum is defined almost entirely by the daily yield they promise.

Investors often try to find the 'exception'—a high-yield program that is also safe. This is a futile search. A program offering 10% daily is not run by a 'better' trader; it's run by an admin who has chosen a business model that requires an insane influx of new cash to survive for even a week. The yield itself dictates the risk because it dictates the program's lifespan.

As Jessica Morgan, a U.S.-based fintech analyst, puts it, "The daily ROI is the program's burn rate. A HYIP offering 1% daily is like a car getting 50 miles per gallon. A HYIP offering 10% daily is like a drag racer burning a gallon of fuel every ten seconds. Both will eventually run out of gas, but one is designed to complete a journey while the other is designed for a spectacular, brief burst of speed before flaming out."

Your job as an investor is to decide what kind of race you want to be in. By understanding that yield and risk are two sides of the same coin, you can align your investment choices with your personal risk tolerance. You can stop chasing the highest numbers and start building a more strategic, balanced portfolio based on a realistic assessment of a program's probable lifespan.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.