Investing in High-Yield Investment Programs (HYIPs) is synonymous with embracing high risk. There is no such thing as a 'safe' HYIP. However, there is a significant difference between gambling blindly and engaging in calculated risk-taking. Experienced participants, from financial centers like Zurich to tech hubs in Tel Aviv, employ a set of strategies designed to mitigate potential losses and maximize the chances of emerging with a profit. This guide outlines the most effective risk management techniques for navigating the treacherous waters of the HYIP world.

This is the most important rule and cannot be overstated. Before you even think about which HYIP to choose, you must decide on a risk capital budget. This is money that, if it vanished tomorrow, would not affect your daily life, your ability to pay bills, or your other financial goals. Treating HYIP investments like a lottery ticket or a trip to Las Vegas is the correct mindset. Chasing losses or investing essential funds is a direct path to financial disaster. This is a core tenet of any sound HYIP investment strategy.

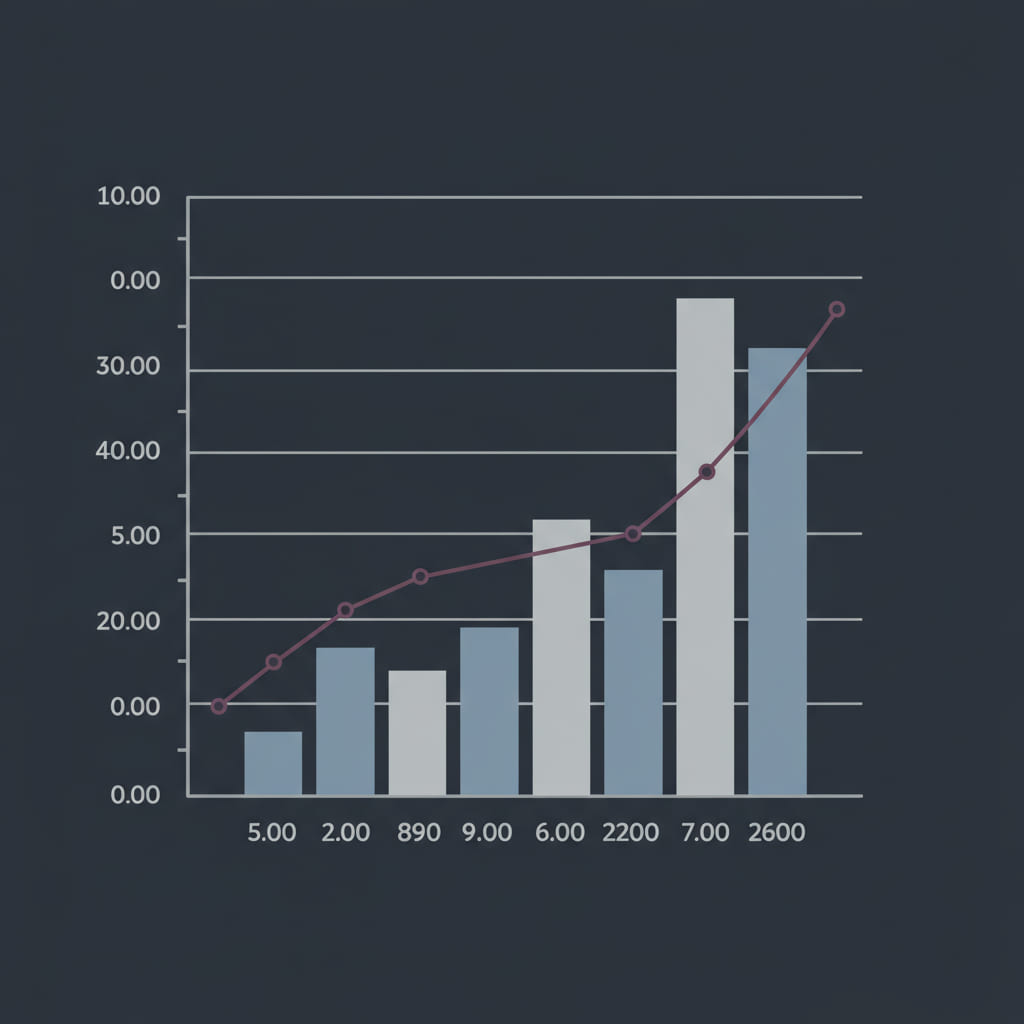

Never put all your eggs in one basket. This age-old wisdom is especially true for HYIPs. The chance of any single program being a scam and collapsing is extremely high. By diversifying your investment capital across multiple programs, you spread the risk.

Diversification doesn't eliminate risk, but it cushions the blow of an individual failure, which is inevitable.

Before you invest, define your exit strategy. Your primary goal should always be to reach the break-even point (BEP) and withdraw your initial capital. Once your principal is safe, you are playing with 'house money'.

As Matti Korhonen, a Helsinki-based financial researcher, states, "The successful HYIP participant is not the one who finds the 'magic' program that never scams, but the one with the discipline to stick to a strict set of risk management rules, regardless of the hype or temptation."

The HYIP landscape can change in an instant. A program that was paying faithfully yesterday can be gone today. Continuous due diligence is not optional. Regularly check your chosen HYIP monitors, participate in forum discussions, and watch for any red flags. Being informed allows you to react quickly to signs of trouble.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.