A Strategic Checklist for Evaluating New HYIP Projects

The HYIP landscape is in constant motion, with new programs launching daily, each vying for investor attention with sleek designs and bold promises. For many players, the key to success is getting into a program early, riding the initial wave of payments, and getting out before it collapses. This strategy, however, is fraught with risk. A new HYIP could be a 'fast scam' that disappears in days, or it could run for weeks or months. How can an investor in a fast-paced market like Dubai or Hong Kong make a calculated decision? This checklist provides a structured framework for evaluating new HYIP projects.

The Due Diligence Checklist

Before depositing any funds, run the new HYIP through this multi-point inspection. A failure in any one of these areas is a warning sign; multiple failures mean you should stay away.

1. Website and Technical Analysis

- Domain and Hosting: Whois the domain name. Is it registered for multiple years? (A one-year registration is common but a multi-year one is a slightly better sign). Is the domain registration private (a red flag)? Is it hosted on a dedicated server with DDoS protection (a sign of a more serious admin)?

- Script and Design: Is it a cheap, generic Goldcoders template, or does it have a unique, custom design? Custom scripts and professional design suggest a larger budget and potentially a longer-term plan. Check for spelling and grammar errors, which indicate a lack of professionalism.

- Security: Does the site have a valid SSL certificate (HTTPS)? This is a basic requirement, and its absence is a deal-breaker.

2. Investment Plan Sustainability

This requires a bit of math and common sense.

- Analyze the ROI: Are the plans realistic within the HYIP world? A plan offering 1.5% daily for 20 days is more believable than one offering 10% daily for 30 days. The latter is unsustainable and will collapse very quickly.

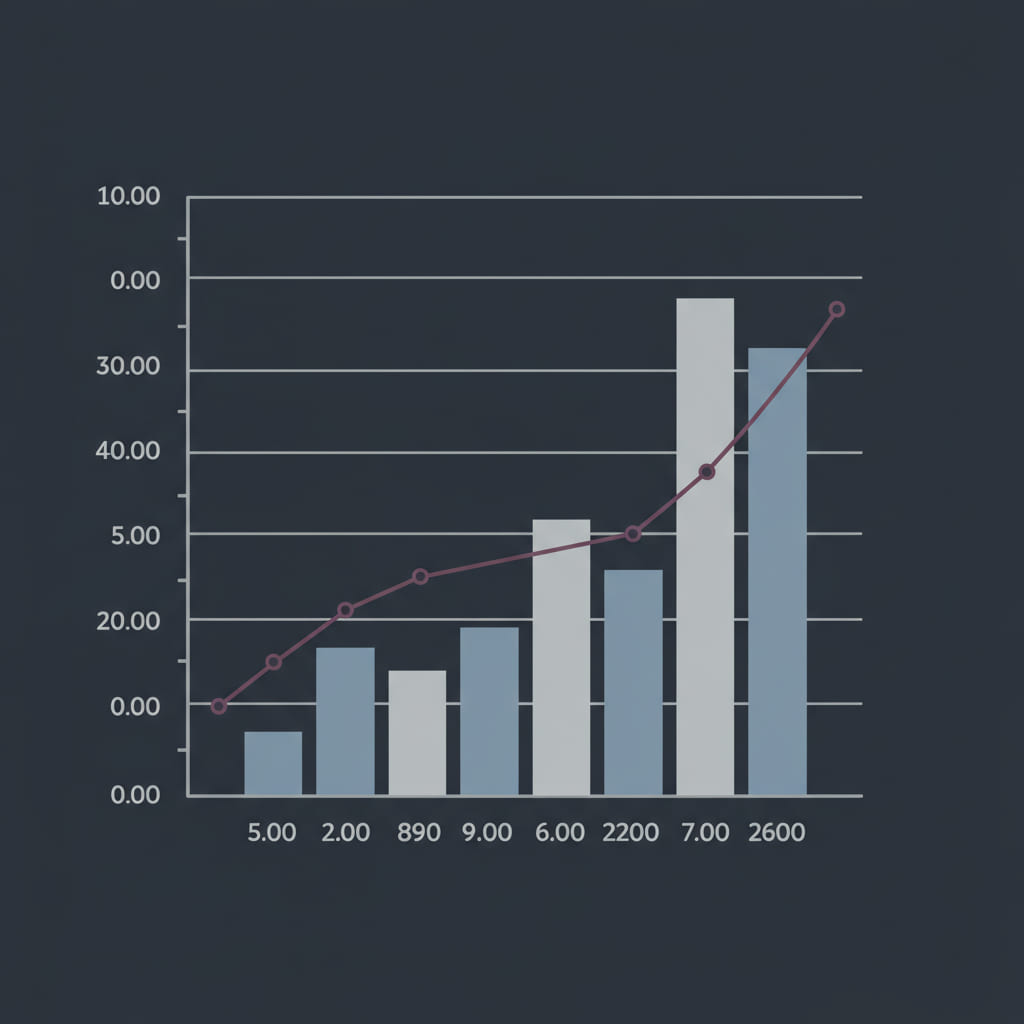

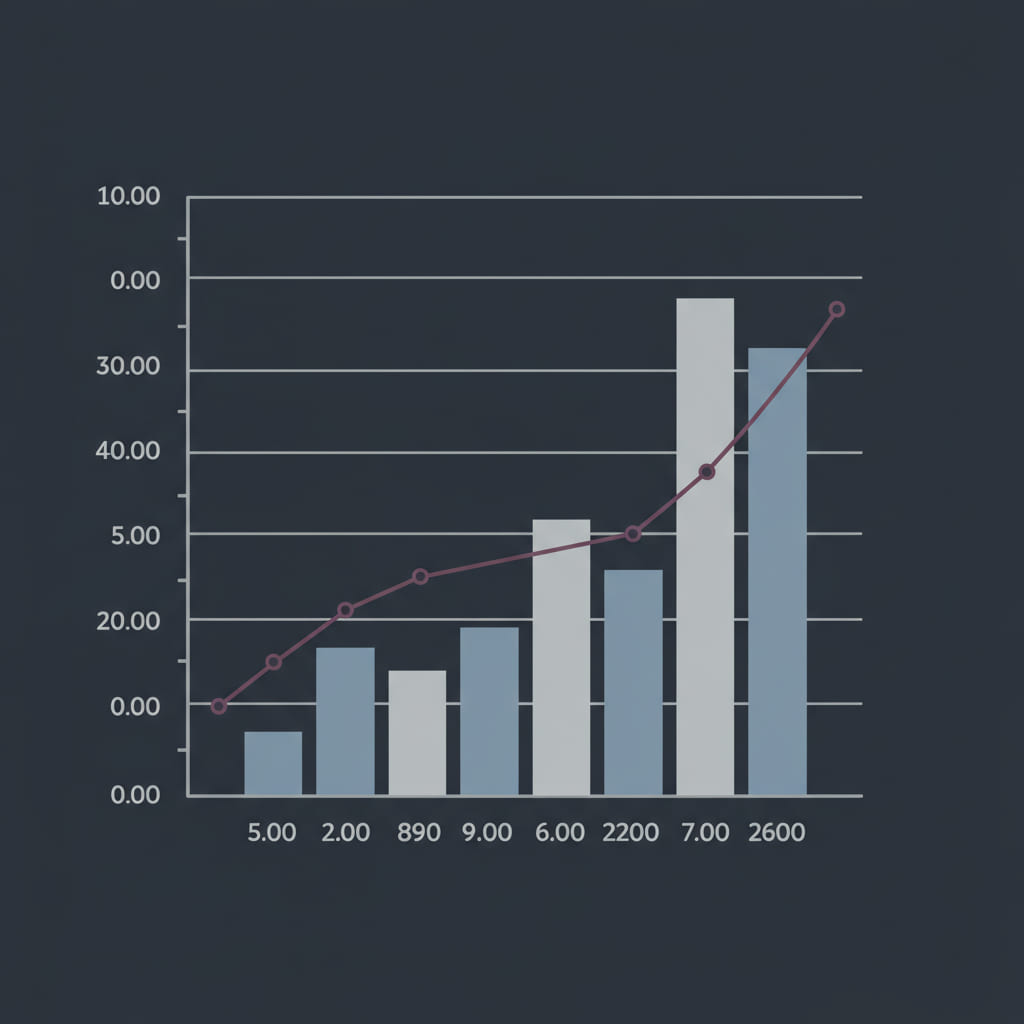

- Calculate the Breakeven Point (BEP): How long will it take to get your initial deposit back? A shorter BEP is less risky. For example, a plan of 5% daily has a BEP of 20 days.

- Look for 'After' Plans: Be extremely cautious of plans that only pay principal and profit at the end of a long term (e.g., 500% after 30 days). These are designed to collect as much money as possible with no intention of paying out.

Our article on calculating ROI delves deeper into this topic.

3. Community and Monitor Presence

- Initial Monitor Listings: Is the program being listed on reputable HYIP monitors? A serious admin will invest in listings on major monitors from day one.

- Forum Buzz: Check the major forums like TalkGold. Is there a thread for the new program? What is the initial sentiment? Be wary of threads started by brand new members with no reputation. Real discussion, as highlighted in our community guide, often includes healthy skepticism.

- Social Media Presence: Check their Telegram channel. Is it active? Are they professionally answering questions, or just posting hype?

4. Administrator's Reputation and Transparency

While most admins are anonymous, there are clues to their experience level.

- Communication: Is the support responsive and professional? Are the website updates and news written clearly?

- Past Projects (If Known): Sometimes, experienced community members can link a new project to a past project by the same admin based on a unique turn of phrase, website design, or server details. A history of successful (i.e., long-running) projects is a positive sign.

- Transparency: While full transparency is impossible, an admin who is active and communicative on forums is generally viewed more favorably than one who is silent.

Conclusion: It's About Risk Mitigation, Not Elimination

Edward Langley, an investment strategist, puts it perfectly:

"Evaluating a new HYIP isn't about finding a 'safe' one. None are safe. It's about identifying programs with characteristics that suggest a potentially longer lifespan, thereby increasing your probability of reaching the breakeven point and realizing a profit. Every step in this checklist is a layer of risk mitigation."

By applying a disciplined and skeptical approach, investors can avoid the most obvious fast scams and make more calculated bets on which new programs might have a chance of a decent run. But always remember the golden rule: never invest more than you can afford to lose.

Author: Edward Langley, London-based investment strategist and contributor to several financial watchdog publications. He focuses on risk assessment and online financial security.