The High-Yield Investment Program (HYIP) phenomenon is global, but it is not monolithic. Investor behavior, program popularity, and market dynamics can vary significantly from one region to another. Asia, with its massive, diverse, and increasingly tech-savvy population, represents one of the largest and most dynamic HYIP markets in the world. This guide will explore some of the key trends and characteristics of the Asian HYIP landscape, offering insights for investors both within and outside the region. One of the defining features of the Asian HYIP market is its sheer scale. Countries like China, India, Vietnam, Indonesia, and the Philippines are home to a vast number of internet users, many of whom are young, upwardly mobile, and open to new forms of online investment. This creates a massive potential investor pool for HYIP admins. Consequently, many HYIPs are specifically marketed towards Asian investors, with websites translated into various Asian languages and marketing campaigns run on popular regional social media platforms like WeChat and Line. This scale means that programs targeting the Asian market can often attract a huge volume of deposits very quickly, leading to explosive growth but also potentially shorter lifecycles.

Cultural factors also play a significant role. In many parts of Asia, there is a strong emphasis on community and social networks, a concept often encapsulated by the Chinese term 'Guanxi.' This cultural trait translates directly into the HYIP world. Referral marketing and word-of-mouth promotion are incredibly powerful in this region. Investors are more likely to trust a program if it is recommended by a friend, family member, or a respected figure in their community. This makes the Asian market particularly fertile ground for HYIPs with strong multi-level marketing (MLM) and referral structures. Admins who understand this will often build elaborate team-building bonuses and leader rewards into their programs. As Matti Korhonen, a Helsinki-based researcher who has studied global fraud patterns, observes, “In the West, HYIP promotion is often more individualistic. In Asia, it is frequently a team sport. This can create huge, tightly-knit downlines that can propel a program to massive heights very quickly.” This community-centric approach is a key aspect of the HYIP community in the region.

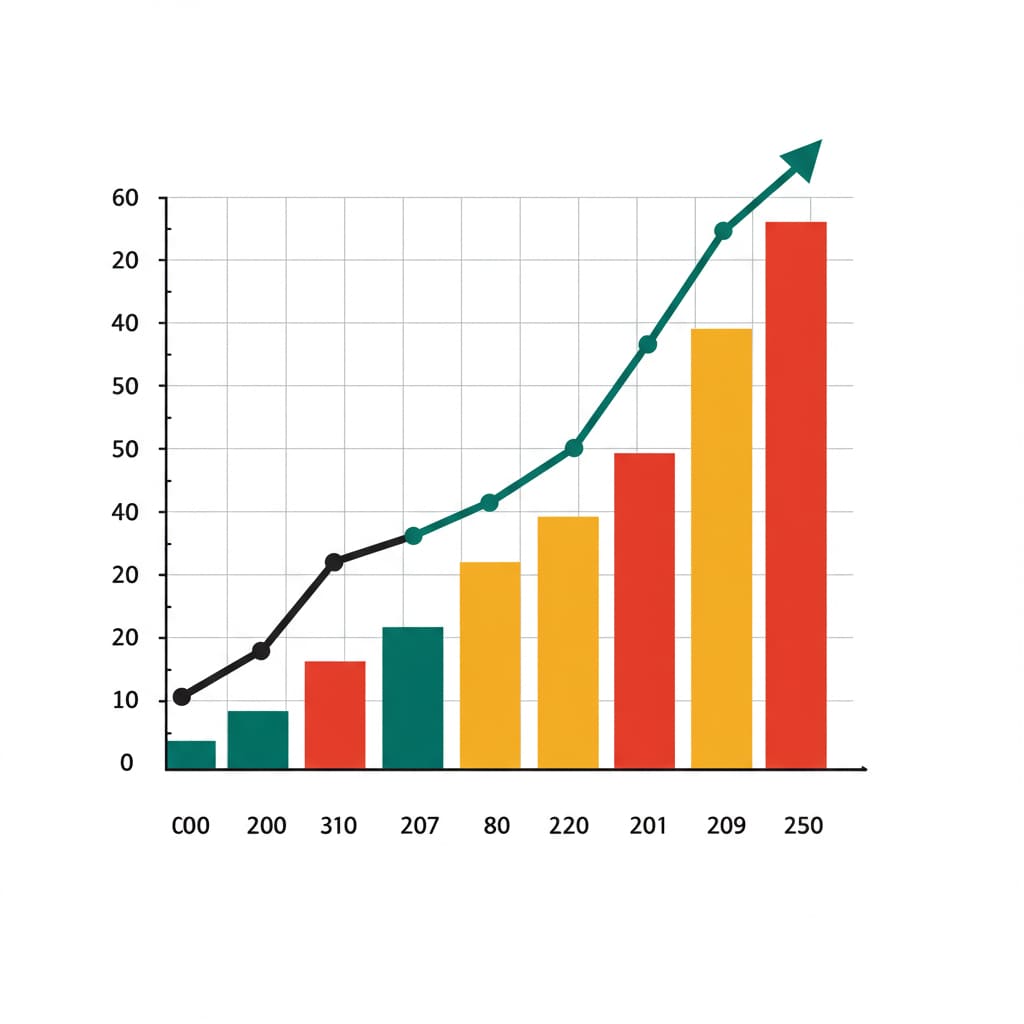

The preferred payment systems in the Asian HYIP market also reflect regional trends. While cryptocurrencies like Bitcoin and Tether (USDT) are universally popular, there is also a higher prevalence of programs that attempt to integrate with local payment gateways and mobile wallets, which are ubiquitous in many Asian countries. The market is also distinctly 'mobile-first.' A huge proportion of investors in Asia access the internet primarily through their smartphones. This means that successful HYIPs in this region must have a well-designed and functional mobile website. Any program that is not optimized for mobile will struggle to gain traction. For a visual representation, consider a map of Asia with hotspots indicating high levels of HYIP activity.  . For investors, understanding these regional trends is crucial. If you are investing in a program that is heavily focused on the Asian market, you should be aware of the potential for very rapid growth and the powerful influence of team leaders and promoters. Monitoring regional social media and forums can provide valuable insights that you might not find on English-language platforms. The Asian HYIP market is a fast-paced and powerful engine in the global ecosystem, and being aware of its unique characteristics is a key part of a sophisticated global diversification strategy and understanding the different payment systems in play.

. For investors, understanding these regional trends is crucial. If you are investing in a program that is heavily focused on the Asian market, you should be aware of the potential for very rapid growth and the powerful influence of team leaders and promoters. Monitoring regional social media and forums can provide valuable insights that you might not find on English-language platforms. The Asian HYIP market is a fast-paced and powerful engine in the global ecosystem, and being aware of its unique characteristics is a key part of a sophisticated global diversification strategy and understanding the different payment systems in play.