The entire High-Yield Investment Program (HYIP) ecosystem is built on a single, non-negotiable principle: a constant inflow of new capital is required to pay the returns of existing investors. This flow of money is the lifeblood of the market. But what happens when this flow slows down or stops? This is known as a 'liquidity trap' or 'liquidity crisis,' and it is the direct cause of every single HYIP collapse. Understanding the dynamics of this trap, how admins react to it, and the signs it produces is essential for predicting the end of a program's life. A liquidity trap occurs when the rate of withdrawals starts to approach or exceed the rate of new deposits. For a Ponzi scheme, this is the beginning of the end. An admin running a program with a 2% daily return needs a significant stream of new money just to stand still. As a program ages, the total daily payout obligation grows exponentially. In the early days, with only a few investors, this is easy to manage. But after a few weeks or months, the admin might need to pay out tens of thousands of dollars every single day. If the new deposits on a given day are less than the required payouts, the admin has to dip into their accumulated 'profits' (the central pool of stolen funds) to cover the shortfall. Once this starts happening consistently, the admin knows their time is limited.

An experienced HYIP admin can see a liquidity squeeze coming. They monitor their daily deposit and withdrawal statistics with extreme care. When they see the trend turning negative, their playbook, which we detailed in The HYIP Admin's Playbook, dictates a specific set of actions designed to stimulate new deposits and prolong the game. Their first move is often a new marketing push. They might start a promotional campaign, offer a limited-time deposit bonus, or increase the referral commission percentage. This is an attempt to boost the inflow of new money. Their communication will become more frequent and more enthusiastic, trying to project an image of success and confidence to counteract the underlying reality of a financial shortfall. As Matti Korhonen, a Helsinki-based researcher, observes, “An admin's marketing activity is often inversely correlated with the program's actual health. A sudden, aggressive promotional campaign in a mature program is not a sign of strength, but a sign of desperation for new liquidity.” This is a key insight for those who follow the subtle signs discussed in The Subtle Art of Reading HYIP Forums.

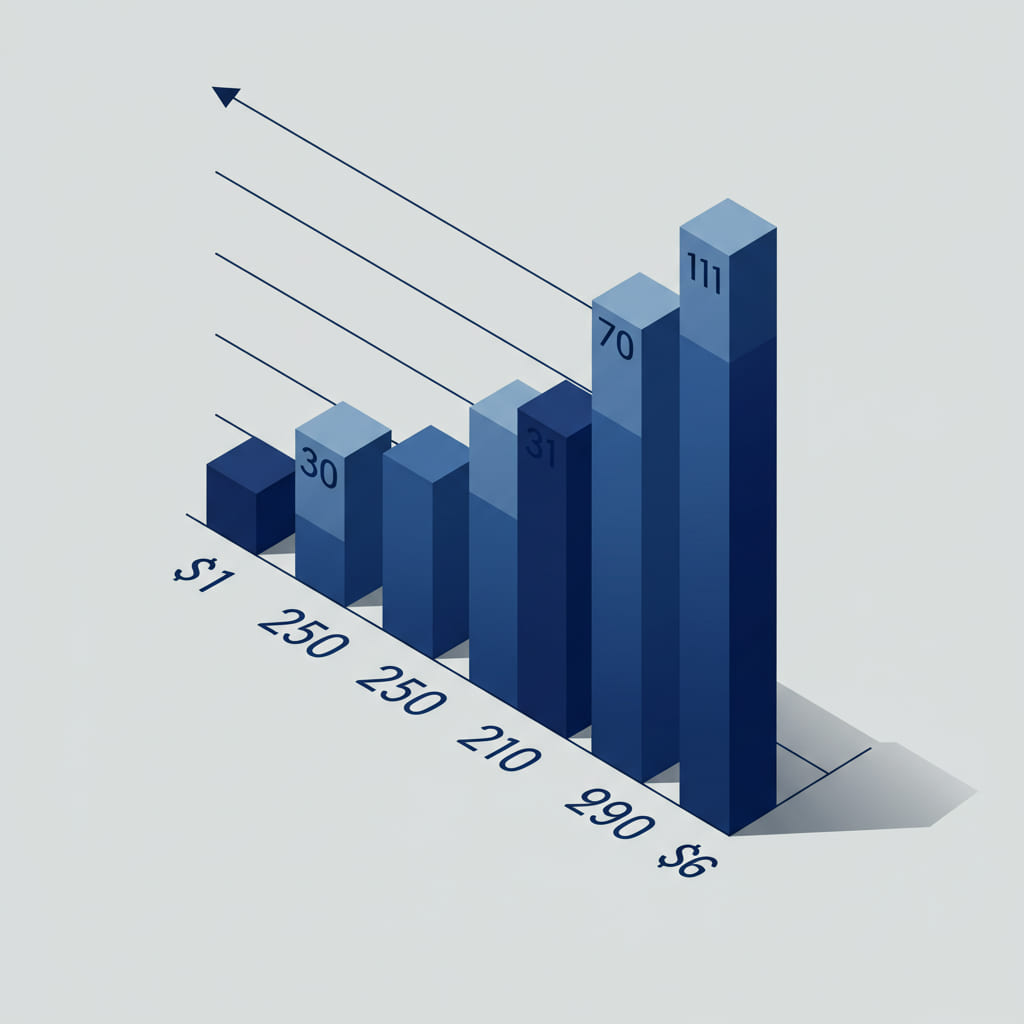

If the marketing push fails to reverse the negative cash flow, the admin moves to the final, more overt stages of an exit scam. This is where they will deploy the tactics we've covered in our guide to HYIP exit scams. They will introduce an impossibly attractive 'last chance' investment plan to suck in a final wave of capital from investors gripped by FOMO. At the same time, they will begin to restrict withdrawals, often starting with the largest ones, while keeping small withdrawals active to maintain the 'Paying' status on monitors for as long as possible. For a visual representation of this liquidity crisis, imagine a water reservoir where the outlet pipe is wider than the inlet pipe, causing the water level to steadily drop.  . For an investor, the key is to think like the admin. Ask yourself: is this program likely attracting enough new money to cover its payout obligations? If a program is old and has a huge number of members, its daily payout requirements are enormous. Unless you see a massive and sustained marketing campaign, it's likely headed for a liquidity trap. This analytical mindset, focusing on the cash flow dynamics of the Ponzi scheme, is a far more reliable predictor of a scam than simply looking at the surface-level design or promises of a program.

. For an investor, the key is to think like the admin. Ask yourself: is this program likely attracting enough new money to cover its payout obligations? If a program is old and has a huge number of members, its daily payout requirements are enormous. Unless you see a massive and sustained marketing campaign, it's likely headed for a liquidity trap. This analytical mindset, focusing on the cash flow dynamics of the Ponzi scheme, is a far more reliable predictor of a scam than simply looking at the surface-level design or promises of a program.