The Lifecycle of a HYIP: From Birth to Inevitable Scam

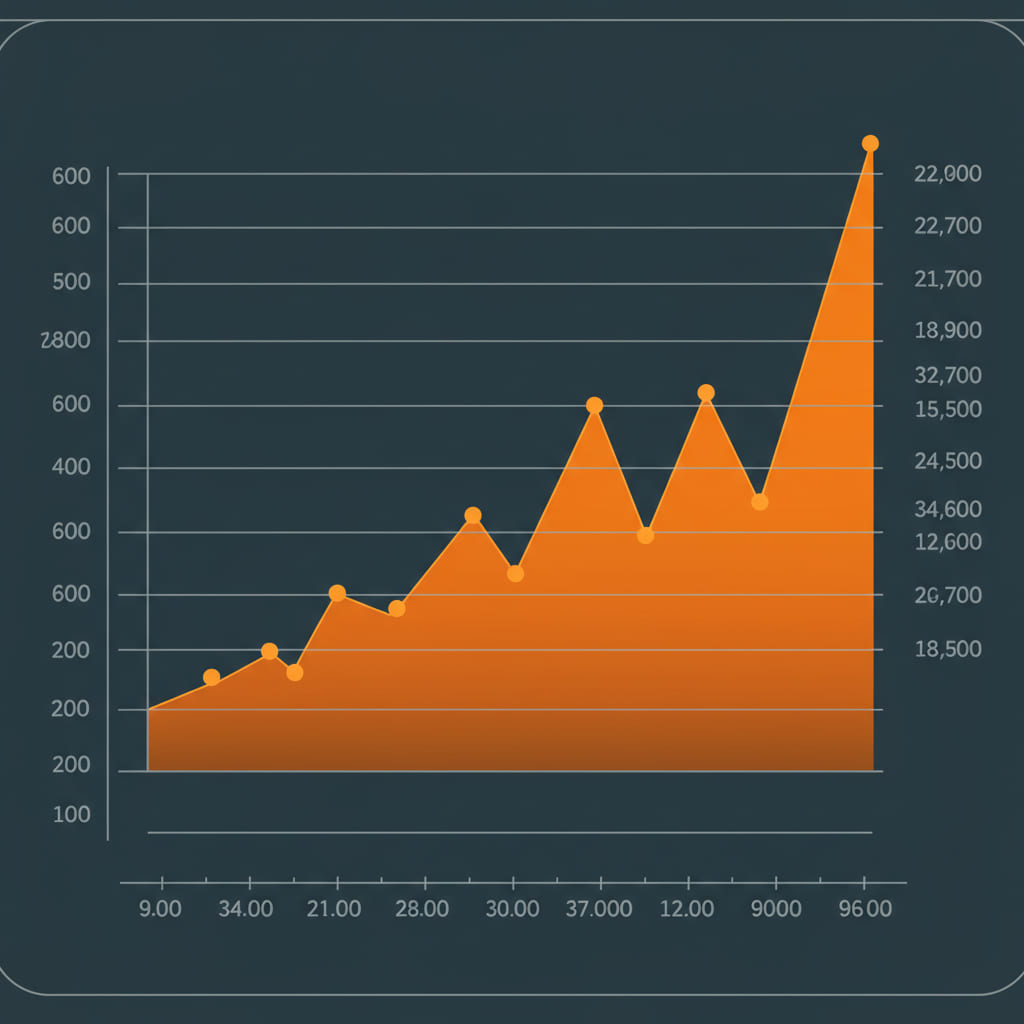

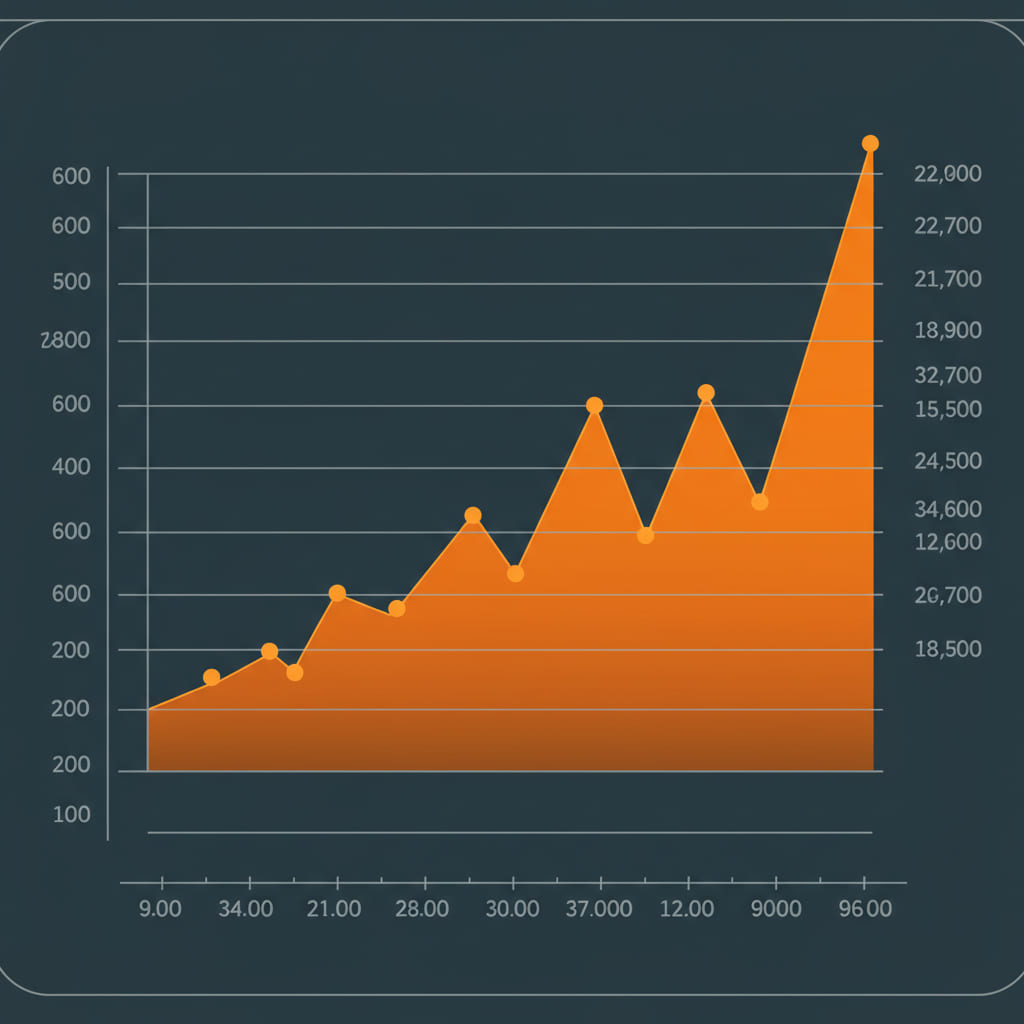

High-Yield Investment Programs are not businesses with uncertain futures; they are constructs with a predictable, finite lifecycle. Like a supernova, they burn incredibly bright and then collapse into nothing. Understanding the distinct phases of this lifecycle is one of the most powerful tools an investor can have. It allows you to estimate where a program is in its journey, helping you decide when to enter, when to be cautious, and when to get out. An investor in Manchester, UK, who understands this cycle is far better equipped than one who believes a program's promise of eternal life.

Phase 1: The 'Sleeper' or Pre-Launch Phase

This is the beginning. The admin has developed the site, set up the technical infrastructure, but has not yet begun marketing. The site is live but effectively hidden.

- Characteristics: Low member count, professional design but no traffic, no listings on monitors.

- Investor Action: This is the territory of the 'sleeper' hunter, an advanced and risky strategy. Most investors are unaware of the program at this stage.

Phase 2: The Launch and Early Growth

The admin begins the marketing push. The program gets listed on a few select, high-quality monitors and is introduced on major forums.

- Characteristics: Initial buzz, first payment proofs appear, slow and steady growth in deposits. The admin is often active and responsive.

- Investor Action: This is often considered the 'golden window' for investment. The program is new, cash flow is positive, and the risk of immediate collapse is relatively low. Due diligence on the program's quality is paramount here.

Phase 3: The Peak and Hype Phase

The program has proven it can pay consistently and its reputation grows. The marketing budget increases dramatically.

- Characteristics: Listings on dozens or even hundreds of monitors. Hype on social media and forums is at a fever pitch. Large numbers of new investors are joining daily. The 'total deposited' numbers are growing exponentially.

- Investor Action: This is a period of high profitability but also rapidly increasing risk. The program is now under immense pressure to maintain its payout schedule. This is the time to be withdrawing profits aggressively and to have already recovered your initial deposit. Reinvesting at this stage, as tempting as it is due to the fear of missing out, is extremely dangerous.

Phase 4: The Plateau and Warning Signs

The influx of new investors begins to slow. The exponential growth is no longer sustainable. The admin knows the end is near.

- Characteristics: The admin may introduce new, ludicrously profitable 'special' plans to attract a final wave of capital. Payment delays may start to appear ('pending' withdrawals). Support becomes less responsive.

- Investor Action: Exit. This is the final warning. Any funds still in the program are at extreme risk. Stop all reinvestment and attempt to withdraw everything possible. Monitor HYIP forums hourly for scam reports.

Phase 5: The Scam and Aftermath

The program stops paying. The website may stay online for a few days with a fake 'technical issue' notice, or it may simply disappear.

- Characteristics: Widespread scam reports on all monitors and forums. The admin is gone. The site eventually goes offline permanently.

- Investor Action: Accept the loss. Do not fall for 'recovery' scams promising to get your money back for a fee. The most valuable action is to perform a post-mortem: why did it scam? Were there warning signs you missed? Use the experience to refine your strategy for the next investment.

Edward Langley, the London-based strategist, treats this cycle as a roadmap. "Every HYIP follows this path. The only variable is the duration of each phase. A 'fast' scam might go from Phase 2 to Phase 5 in a week. A 'legend' might stay in Phase 3 for six months. The skill is not in finding a program that breaks the cycle, but in accurately identifying which phase a program is in right now." This analytical approach is crucial for survival.

Author: Edward Langley, London-based investment strategist and contributor to several financial watchdog publications. He focuses on risk assessment and online financial security.