For investors who have moved past the basics of HYIPs, developing advanced strategies is key to maximizing potential returns while aggressively managing the immense risk. Simple, single investments are rarely a path to long-term success in this arena. Instead, seasoned investors from financial centers like Zurich and Hong Kong employ a portfolio approach, using techniques like diversification, calculated compounding, and disciplined profit-taking to navigate the volatile landscape.

The most fundamental advanced strategy is to never put all your eggs in one basket. Because any single HYIP can scam at any moment, spreading your capital across multiple programs is essential.

Diversification is a cornerstone of traditional investing, and its principles are equally valid here. For more on this, you can explore broader investment concepts like the importance of diversification as explained by Investopedia, a highly trusted financial resource.

Compounding, or reinvesting your earnings, can lead to exponential growth. However, in the HYIP world, it's a double-edged sword. Every dollar you compound is a dollar you haven't secured in your own wallet.

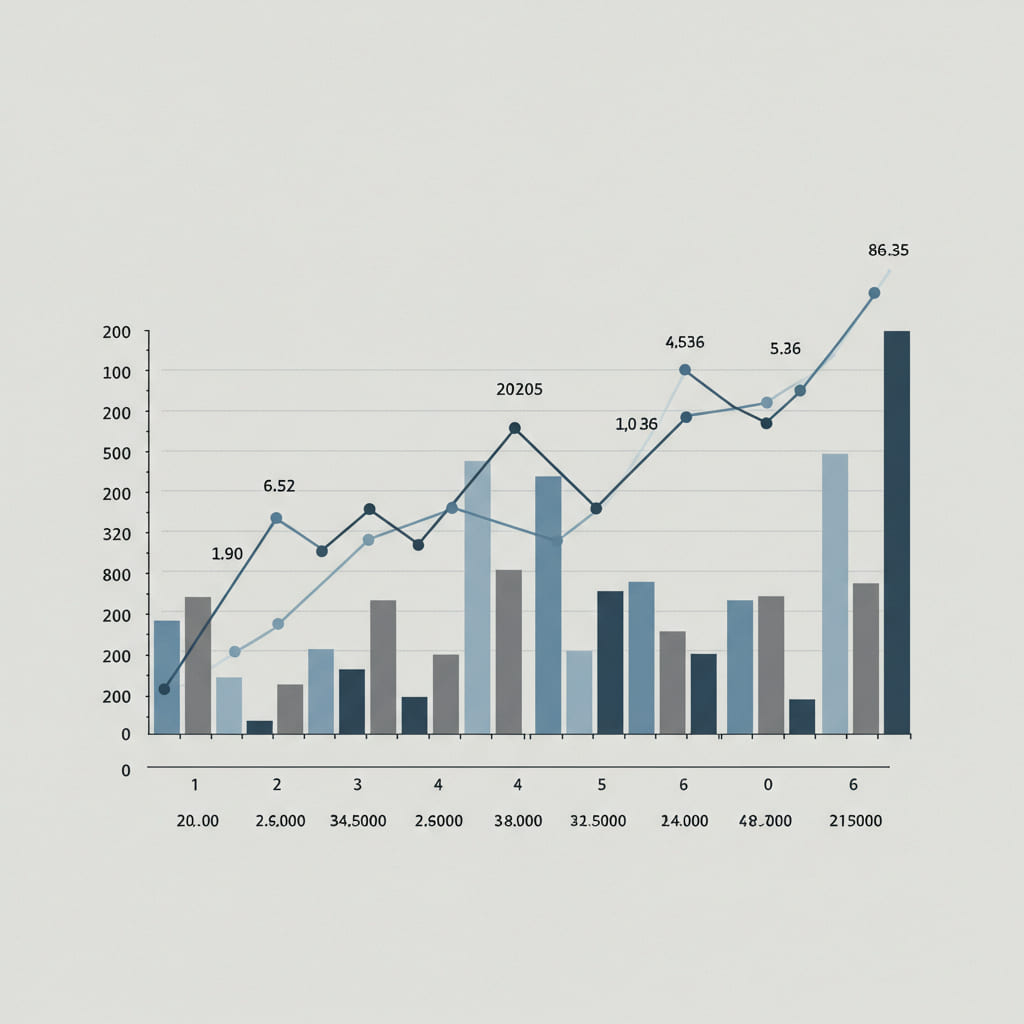

The chart below shows the explosive potential of compounding interest versus simple interest in a hypothetical scenario. It highlights the allure that leads many investors to take on this additional risk.

This is an aggressive strategy for short-term plans. The goal is to invest in a new, promising HYIP, stay in only for the shortest possible plan duration, and then withdraw your principal and profit completely. This tactic requires excellent timing and constant monitoring of community forums for any sign of trouble. It's a high-stress, high-reward approach that is not suitable for beginners but is a staple for many experienced players who understand the short lifecycle of these programs.

Author: Edward Langley, London-based investment strategist and contributor to several financial watchdog publications. He focuses on risk assessment and online financial security.