One of the most appealing aspects of High-Yield Investment Programs is their clear, advertised return rates. However, understanding how to calculate your actual Return on Investment (ROI) and net profit is crucial for making informed decisions and managing your expectations. Investors in cities like Frankfurt and Seoul, known for their financial acumen, always focus on the numbers behind the promises. Let's break down the key metrics and how to calculate them.

HYIPs present their plans in various ways. A common format is 'X% daily for Y days'. For example, a plan might offer '2% daily for 60 days'.

However, the total return is not your net profit. You must account for your initial investment.

The two most important calculations for any investor are:

1. Net Profit: This tells you how much money you've actually made on top of your initial capital.

Formula: Net Profit = Total Amount Withdrawn - Initial Deposit

2. Return on Investment (ROI): This expresses your net profit as a percentage of your original investment, allowing you to compare the performance of different programs.

Formula: ROI (%) = (Net Profit / Initial Deposit) * 100

Let's say you invest $1,000 in a plan offering '2% daily for 60 days'.

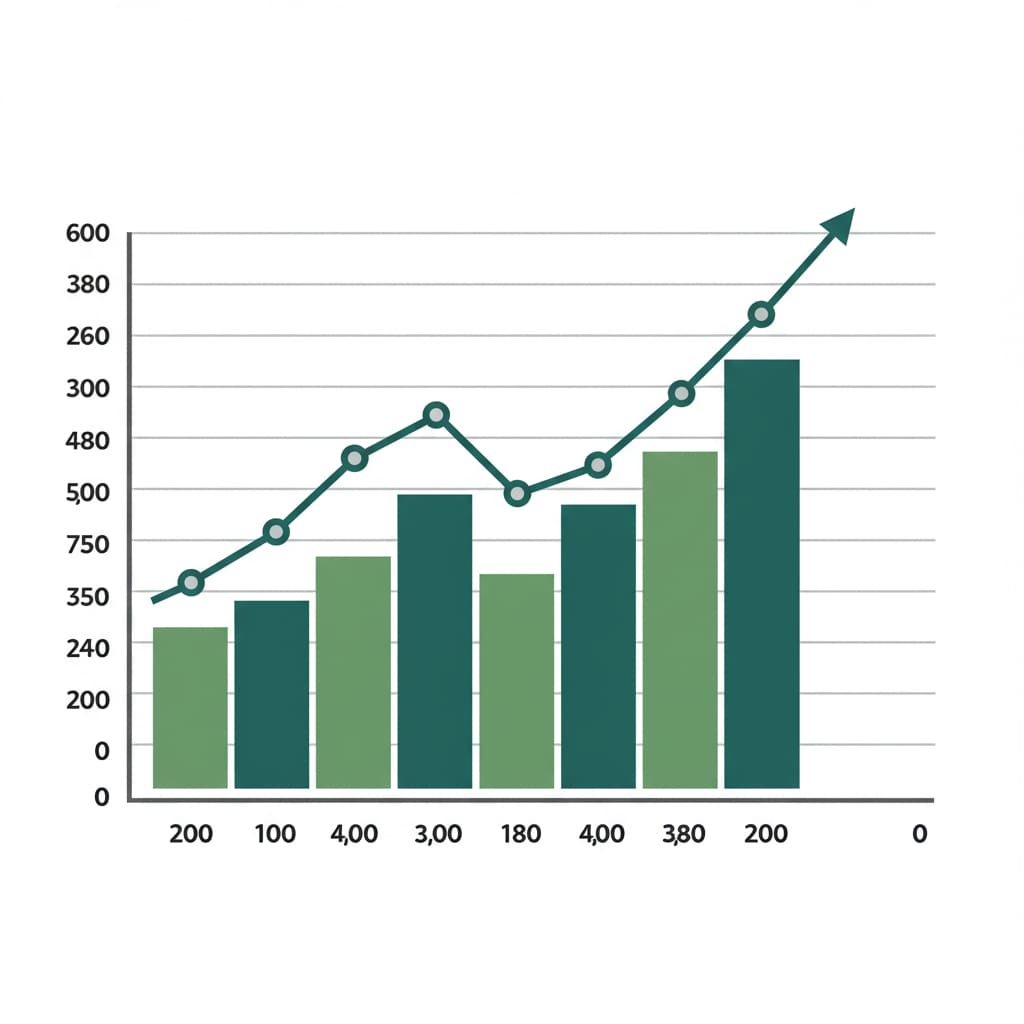

This visualization shows how compounding, if offered, can dramatically alter returns. The chart below illustrates a hypothetical scenario of daily compounding on an initial investment.

This simple 20% ROI is a best-case scenario. It assumes the HYIP pays for the full 60-day term. The real risk is that the program scams before you reach your break-even point. This is why many experienced investors use advanced strategies, a topic we cover in our guide to advanced HYIP strategies. The concept of ROI is fundamental, but it must be viewed through the lens of extreme risk, which is a core theme in our guide to avoiding scams.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.