In the world of High-Yield Investment Programs, investors are bombarded with metrics: daily ROI, total return, referral commissions, and more. However, for the disciplined and successful investor, from the cautious planner in Frankfurt to the experienced trader in Seoul, there is only one metric that truly matters: the Break-Even Point (BEP). The BEP is the moment in time when you have successfully withdrawn an amount of money equal to your initial investment. It is the point where your risk in that program drops to zero. Every dollar earned after reaching your BEP is pure, risk-free profit. Making the calculation and disciplined pursuit of the BEP your number one priority is the most effective strategy for long-term survival in the HYIP arena.

Focusing on the BEP fundamentally changes your investment psychology from offensive to defensive. Your goal is no longer to maximize potential profit, but to minimize and eliminate risk as quickly as possible. Once your initial capital is safely back in your own wallet, the psychological pressure lifts. You are now playing with 'house money'. This allows you to make more rational decisions, free from the fear of losing your principal. It also enforces a crucial discipline: taking profits off the table. The on-screen balance in your HYIP account is just a number in a database; the money in your personal crypto wallet is real. The BEP marks the transformation of an investment from a liability into an asset.

Calculating your BEP is simple, but it depends entirely on the type of investment plan. As we've detailed in our guide to calculating real ROI, plans are typically 'principal included' or 'principal returned'.

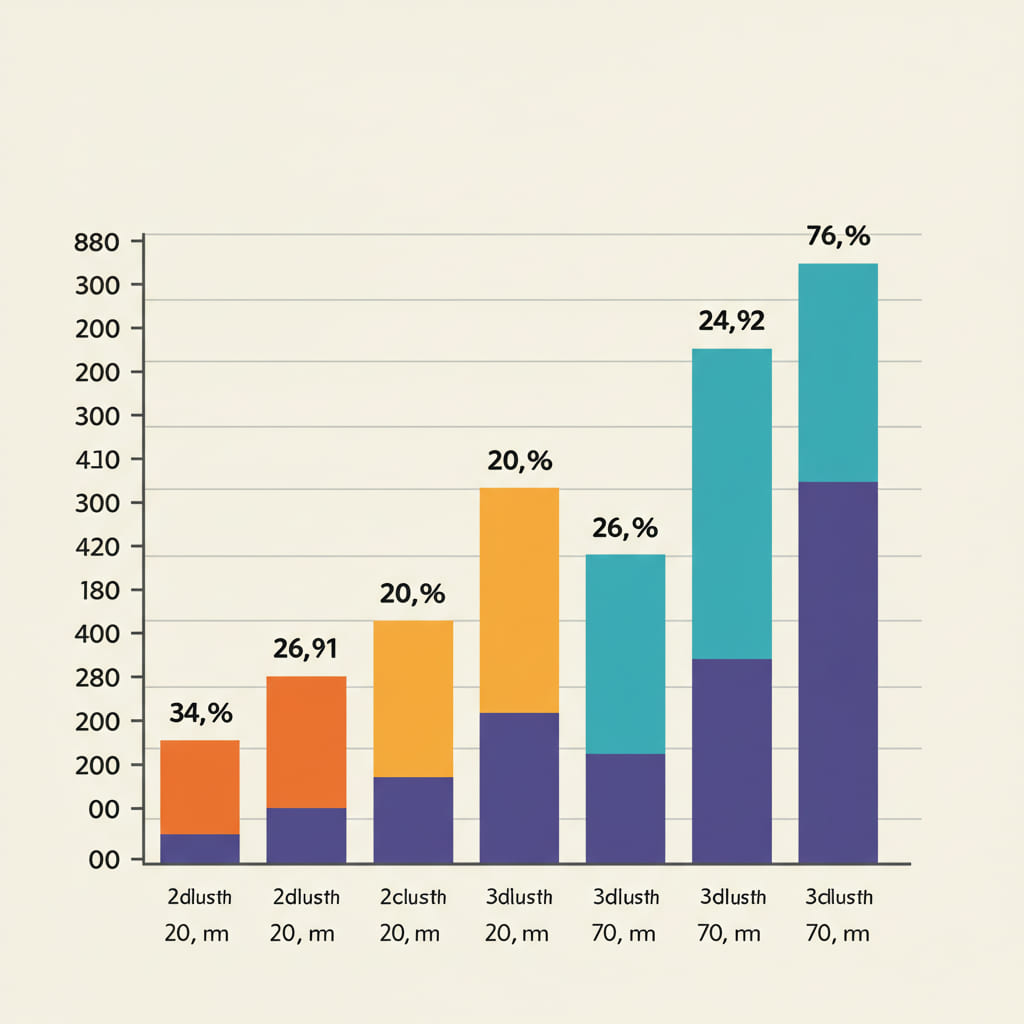

The chart below visualizes the BEP for different daily return percentages on 'principal included' plans.

As you can see, a higher daily return leads to a faster BEP, but it also often signals a riskier, shorter-lived program. The sweet spot is a plan that offers a reasonable daily return from a program that shows signs of being one of the potential marathon runners. This focus on capital preservation is a core tenet of investing, championed by legendary investors like Benjamin Graham and Warren Buffett, and is a concept promoted by educational resources like Investopedia. In the high-risk HYIP world, this defensive mindset is not just wise—it's everything.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.