In the perilous world of high-yield investing, the concept of 'insurance' is incredibly alluring. Some popular HYIP monitors offer an insurance fund for specific programs they list, promising to partially or fully reimburse the losses of their referrals if the program scams. This feature is a powerful marketing tool, creating a perception of safety and encouraging investors to sign up under that monitor's link. But is this insurance a genuine safety net, or just a sophisticated illusion?

The idea is simple: a HYIP admin pays an extra fee to a monitor to have their program 'insured'. The monitor puts this fee into a public fund. If the program collapses before investors have reached their break-even point, the monitor uses this fund to distribute compensation to their direct referrals. It sounds great on paper and can provide a psychological cushion for nervous investors. An investor in Sydney might choose a program with insurance over one without, believing it reduces their risk.

It's crucial to look behind the curtain. Here are the realities of HYIP insurance:

Matti Korhonen, a researcher specializing in investment monitoring, offers this perspective:

"HYIP insurance is a feature, not a guarantee. It's better than nothing, but it should never be the primary reason you invest in a program. Treat it as a potential small rebate on a loss, not as a shield that makes you invincible. Your best insurance policy is still a solid risk management strategy and relying on the data from multiple, reliable HYIP monitors, not just the insured ones."

In conclusion, while an insurance fund can be a minor factor in your decision-making, it should be at the bottom of your checklist. Focus on the fundamental quality of the project, its sustainability, and community feedback. True security in the HYIP space doesn't come from a gimmick; it comes from your own diligence.

Author: Matti Korhonen, independent financial researcher from Helsinki, specializing in high-risk investment monitoring and cryptocurrency fraud analysis since 2012.

In the perilous landscape of High-Yield Investment Programs, where scams are the rule rather than the exception, any feature that promises security is bound to attract attention. One such feature that has gained popularity is 'insurance' for HYIPs. Typically offered by monitoring websites or large promoters, this 'insurance fund' promises to partially or fully reimburse investors if a specific, insured program turns into a scam. For an investor in a place like Rome or Seoul, this can sound like a revolutionary safety net. But is it a real form of protection, or is it merely a sophisticated marketing gimmick designed to encourage larger deposits into risky programs? This guide will dissect the concept of HYIP insurance.

The model, on the surface, seems straightforward. A HYIP administrator pays a large fee to a monitor or a group of monitors. This fee goes into a designated 'insurance fund' for that specific program. The monitor then heavily advertises the program as 'insured'. The promise is that if the program scams before the investors in the monitor's downline have reached their break-even point, the monitor will use the insurance fund to pay them back, up to the insured amount. For example, a monitor might offer '100% insurance on your principal' for a specific HYIP. This makes investors feel protected, leading them to invest more than they otherwise would.

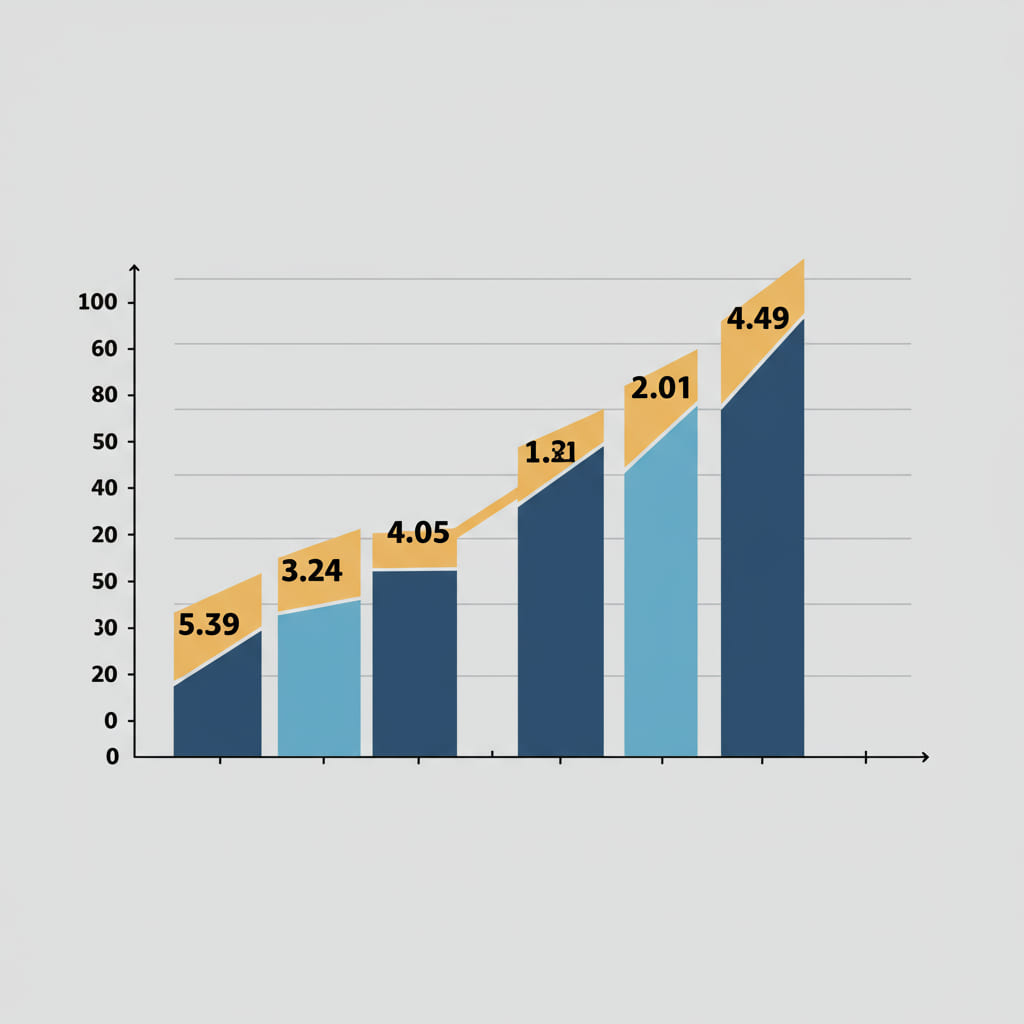

The chart below shows the advertised flow of funds in an insurance scheme.

While it sounds good in theory, the HYIP insurance model is riddled with problems and is largely considered a marketing tool rather than a legitimate financial guarantee.

Legitimate insurance is a highly regulated industry, with companies needing to meet strict capital requirements, as outlined by bodies like the National Association of Insurance Commissioners in the US. HYIP insurance has none of these safeguards. While it may offer a tiny psychological comfort, it should never be a factor in your decision to invest. Your best insurance policy is a well-diversified rebalanced portfolio and a healthy dose of skepticism.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.