Creating a diversified HYIP portfolio is only the first step. A portfolio, once created, cannot be left on autopilot. It must be actively managed. Rebalancing is the process of periodically adjusting your portfolio's composition to maintain your desired level of risk and to strategically reinvest profits. For the serious HYIP player, rebalancing is the key to locking in gains, managing risk, and ensuring long-term, sustainable growth. It transforms you from a passive participant into an active portfolio manager.

In traditional investing, rebalancing usually means selling some assets that have grown a lot and buying more of those that have underperformed to get back to your target allocation. In the HYIP world, the concept is slightly different. It generally involves two primary actions:

This is a core concept that builds on the principles of advanced diversification. It's not just about how many baskets you have, but about actively managing what's in them.

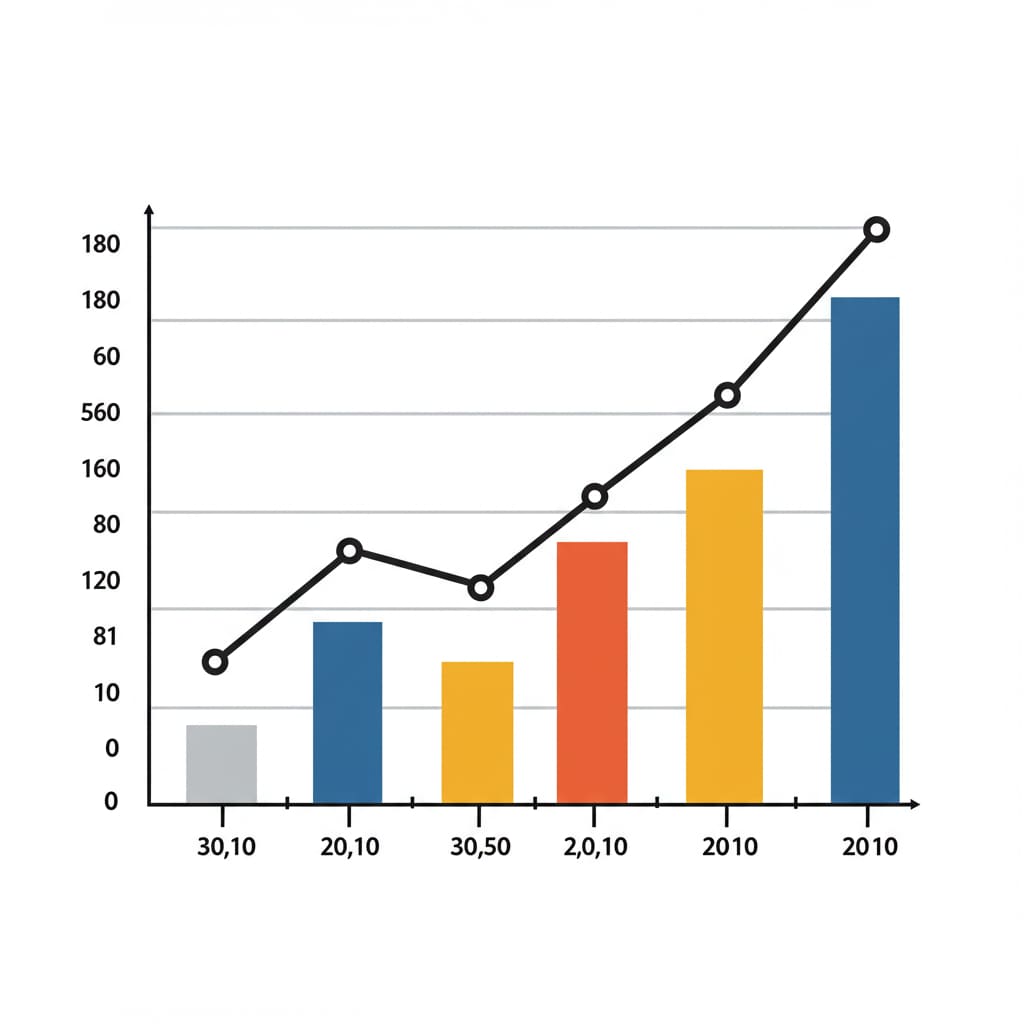

Here is a simple, structured approach to rebalancing your HYIP portfolio, which could be done on a weekly basis.

Step 1: The Weekly Withdrawal Sweep

At the end of each week, your goal should be to 'sweep' all the profits you've earned that week from your various HYIP-related wallets (like your Perfect Money account or your HYIP 'hot wallet') to your secure, 'cold' storage. This is the act of 'realizing' your gains. On-screen profits are a fantasy; only money in your secure personal wallet is real.

Step 2: The '80/20' Allocation Rule

Once you have your weekly profit sweep, you apply a simple allocation rule. For example, the 80/20 rule:

This rule provides a powerful balance. It forces you to consistently take the majority of your profits off the table, preventing you from getting too greedy and over-committing, while still providing you with fresh capital to pursue new opportunities.

Beyond a simple weekly schedule, you should also have triggers for rebalancing specific positions.

Rebalancing is the discipline that separates professional players from amateurs. It is the active process of turning short-term wins into long-term growth and resilience. It is the very definition of a proactive, rather than a reactive, investment strategy.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.