To the new investor, a High-Yield Investment Program monitor appears to be a public service—a watchdog dedicated to protecting the community by tracking the payment status of risky programs. While they do serve this function to some extent, it's crucial for every investor to understand that HYIP monitors are for-profit businesses with a very specific and often conflicted business model. Their primary goal is not to protect you; it's to generate revenue. Understanding how they make their money is essential for interpreting their ratings and statuses with the necessary level of skepticism. This guide peels back the curtain on the real business of HYIP monitoring.

The vast majority of a monitor's income comes from referral commissions. This is the engine of their entire operation. When a monitor lists a program, they use their unique referral link. Every investor who clicks through from the monitor and makes a deposit earns the monitor a commission (typically 3-10% of the deposit). This creates a direct financial incentive for the monitor to drive as much traffic and as many deposits as possible to the programs they list. Their revenue is directly proportional to the amount of money investors deposit through their links. This fundamental conflict of interest is something we touch on in our guide to HYIP referral programs, but its impact on monitors is particularly profound.

In addition to referral commissions, monitors have several other ways to monetize their websites:

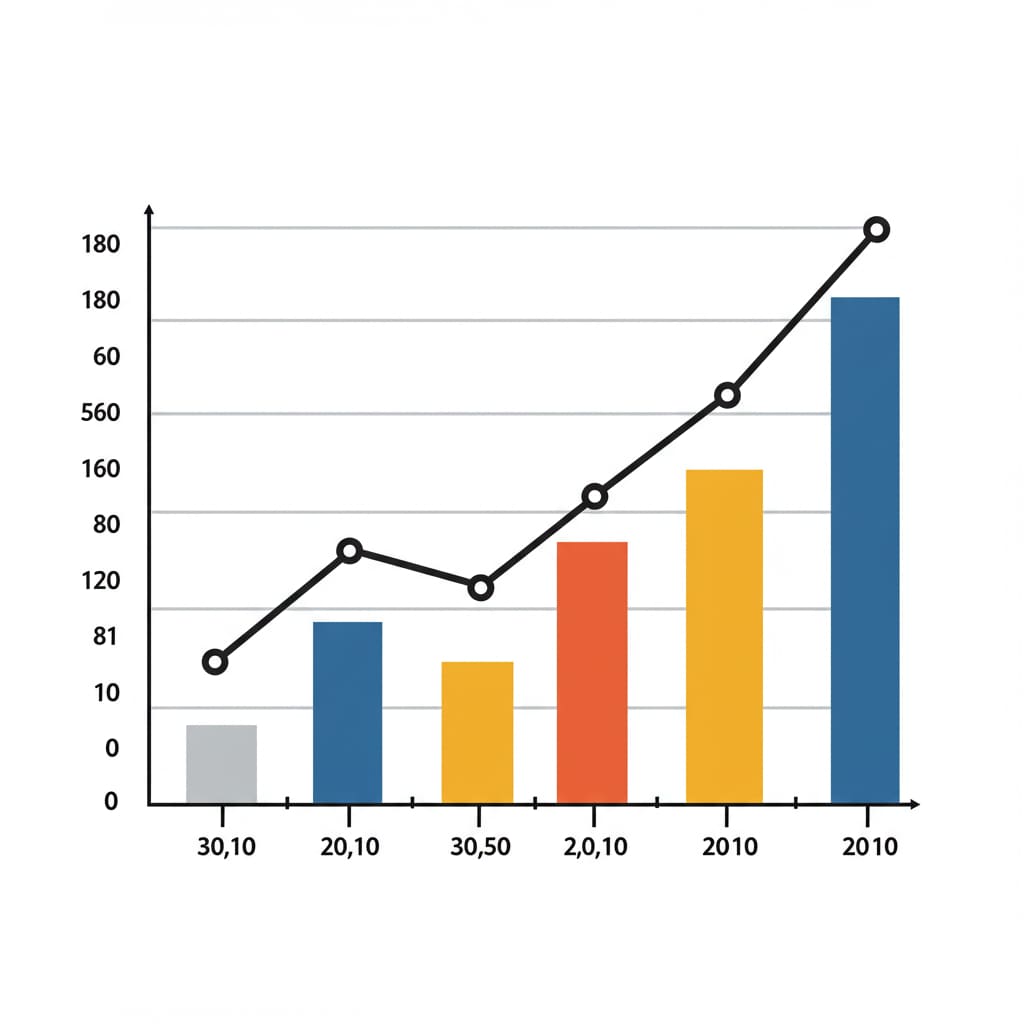

The chart below illustrates a typical monitor's revenue breakdown.

This business model means you must view the information on monitors with a critical eye.

This dynamic is not unique to HYIPs; many online review and comparison sites operate on a similar affiliate model. For general knowledge on affiliate marketing, resources like Neil Patel's blog offer great explanations. The key takeaway is to use monitors as one tool among many, alongside your own due diligence and community feedback from independent forums.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.