The term 'high-yield' is not exclusive to the shadowy world of HYIPs. In the broader financial landscape, especially with the advent of Decentralized Finance (DeFi), there are legitimate opportunities that can offer returns significantly higher than traditional savings accounts. However, it is absolutely critical for investors to understand the fundamental differences between a fraudulent HYIP and a legitimate, albeit still risky, high-yield investment. Confusing the two can lead to catastrophic financial loss. This comparison will clarify the key distinctions.

The single most important distinction lies in transparency. A HYIP operates in a black box, while legitimate platforms operate in a glass box.

All investments carry risk, but the nature of that risk is profoundly different.

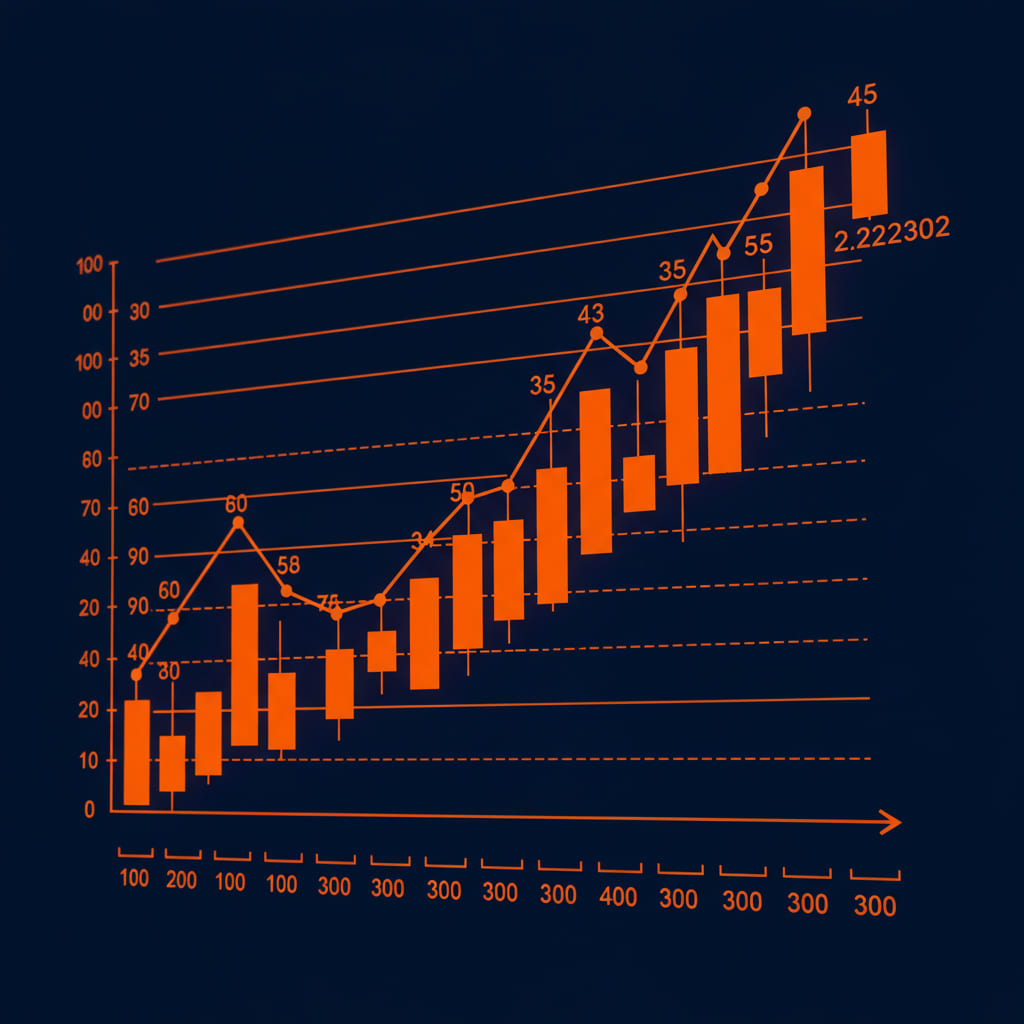

The visual above illustrates the core difference. One system is deliberately opaque, the other is built on transparency. While some HYIPs are now theming themselves as 'DeFi' or 'AI' platforms, they fail the transparency test. A real DeFi project will have its code available on GitHub and its transactions verifiable on a block explorer. A crypto HYIP merely uses crypto as a payment method; it does not adopt the transparent ethos of crypto's DeFi sector.

HYIP admins are adept at co-opting the language of legitimate finance. They will create websites that look and sound like real investment platforms. It is your job to look past the marketing and ask the hard questions: Can I verify your claims? Is your process transparent? Who holds the funds? If the answers are vague or non-existent, you are dealing with a HYIP, not a legitimate investment. The potential for high yield should never blind you to the fundamental nature of the platform you are using.

Author: Jessica Morgan, U.S.-based fintech analyst and former SEC compliance consultant. She writes extensively about digital finance regulation and HYIP risk management.