The High-Yield Investment Program (HYIP) market does not exist in a steady state; it moves in cycles of boom and bust. Occasionally, the market enters a particularly brutal phase known as an 'HYIP winter.' This is a period where a large number of major, long-running programs all seem to collapse in a short space of time, leading to massive investor losses and a widespread crisis of confidence. These market-wide collapses can be devastating, even for diversified investors. Understanding the potential causes of an HYIP winter and how to adjust your strategy to survive one is a key aspect of advanced risk management. An HYIP winter is often triggered by a major external shock, or a black swan event. For example, a sudden, sharp crash in the price of Bitcoin can put immense pressure on the entire ecosystem. As the value of their crypto assets plummets, investors have less 'play money' to deposit into new HYIPs. This drying up of fresh capital can cause a domino effect, where even well-managed Ponzi schemes find themselves unable to meet their payout obligations, leading to a cascade of failures. Another common trigger is the collapse of a single, massive, and widely trusted 'super HYIP.' When a program that has been running for a very long time and has attracted a huge amount of investment finally scams, it can have a chilling effect on the entire market. It wipes out a significant amount of investor capital, meaning there is less money available to flow into other programs. It also creates a climate of extreme fear and skepticism, causing investors to withdraw from other programs en masse, which in turn can trigger their collapse.

While difficult to predict, there are some signs that may indicate the onset of an HYIP winter. You might notice that even high-quality, professional-looking new programs are failing to gain traction and are scamming very quickly. This suggests a lack of fresh capital in the market. You may also see a general mood of negativity and cynicism on the major forums, with more scam reports than success stories. Another indicator is a 'flight to quality,' where investors pull their money out of all but the one or two oldest and most trusted programs, but no new programs are able to grow. As Edward Langley, a London-based investment strategist, observes, “An HYIP winter is essentially a liquidity crisis. It's a system-wide deleveraging event where trust evaporates and the flow of new capital freezes. Recognizing the signs of this systemic risk, as opposed to just program-specific risk, is a key skill.” This is a reality for investors in all markets, from the Americas to Europe to Asia.

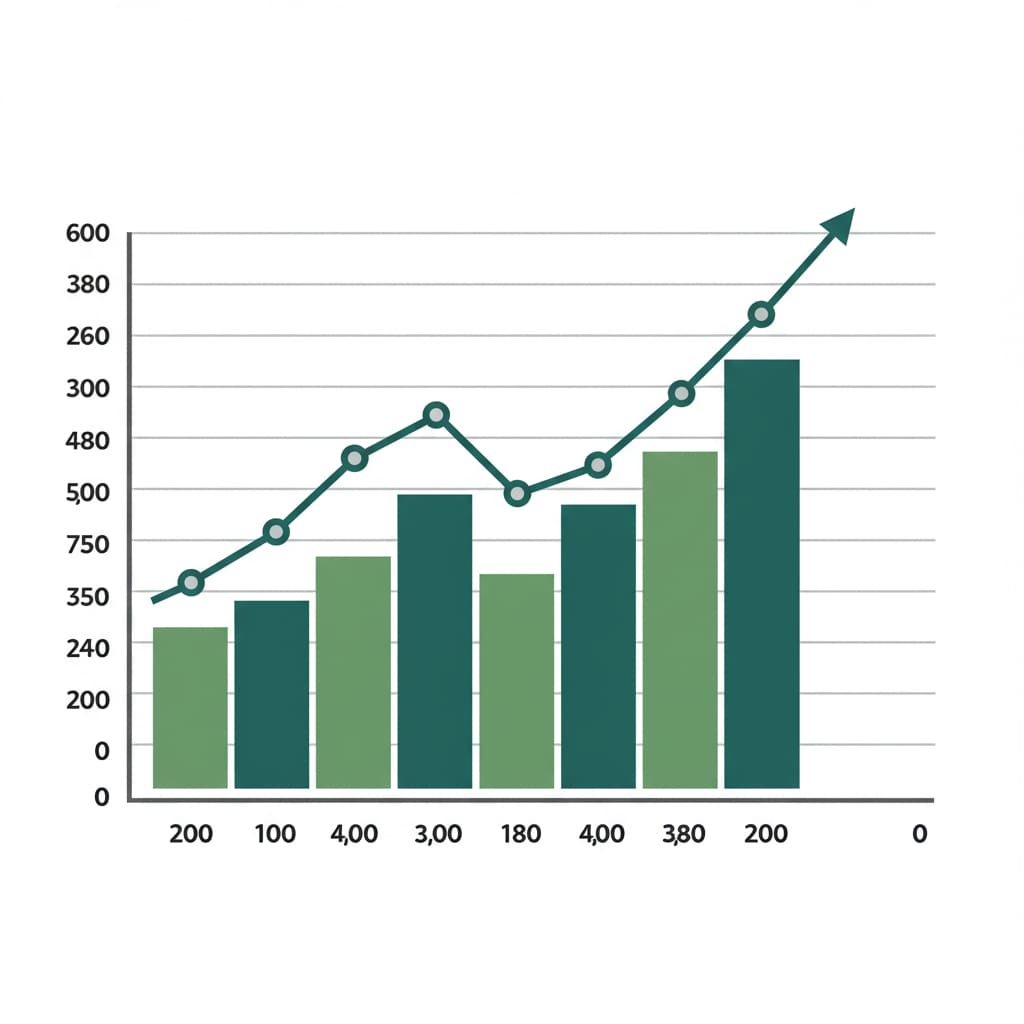

So, how do you survive an HYIP winter? The first and most important strategy is to have already been practicing good bankroll management by regularly taking profits out of the ecosystem entirely. Those who have consistently cashed out their earnings will be insulated from the crash. During a winter, the best course of action is often to do nothing. It is a time to be extremely defensive. It's wise to significantly reduce your investment activity or even to stop investing in new programs altogether and simply observe from the sidelines. Trying to 'catch a falling knife' by investing in new programs during a market-wide collapse is an almost certain way to lose money. For a visual metaphor, imagine a farmer letting a field lie fallow during a harsh winter to allow it to recover.  . Wait for the green shoots of a recovery: the emergence of new, high-quality programs that are able to attract investment and pay for a sustained period. The market will eventually recover, as a new generation of investors and admins enters the space. Patience is the ultimate survival tool during an HYIP winter.

. Wait for the green shoots of a recovery: the emergence of new, high-quality programs that are able to attract investment and pay for a sustained period. The market will eventually recover, as a new generation of investors and admins enters the space. Patience is the ultimate survival tool during an HYIP winter.